It’s standard practice in nuclear ballistic missile submarine fleets throughout the world to periodically demonstrate you can actually launch a warbird successfully.

“Success” is defined as the warhead lands within the down-range target area.

Another measure of success is you don’t destroy your boat trying to light one off.

The Royal Navy dodged “yet-another” bullet the other day in one of its recent Trident missile tests — they seem to repeat their failures regularly.

Even back in my day, the Royal Navy was a sketchy operation.

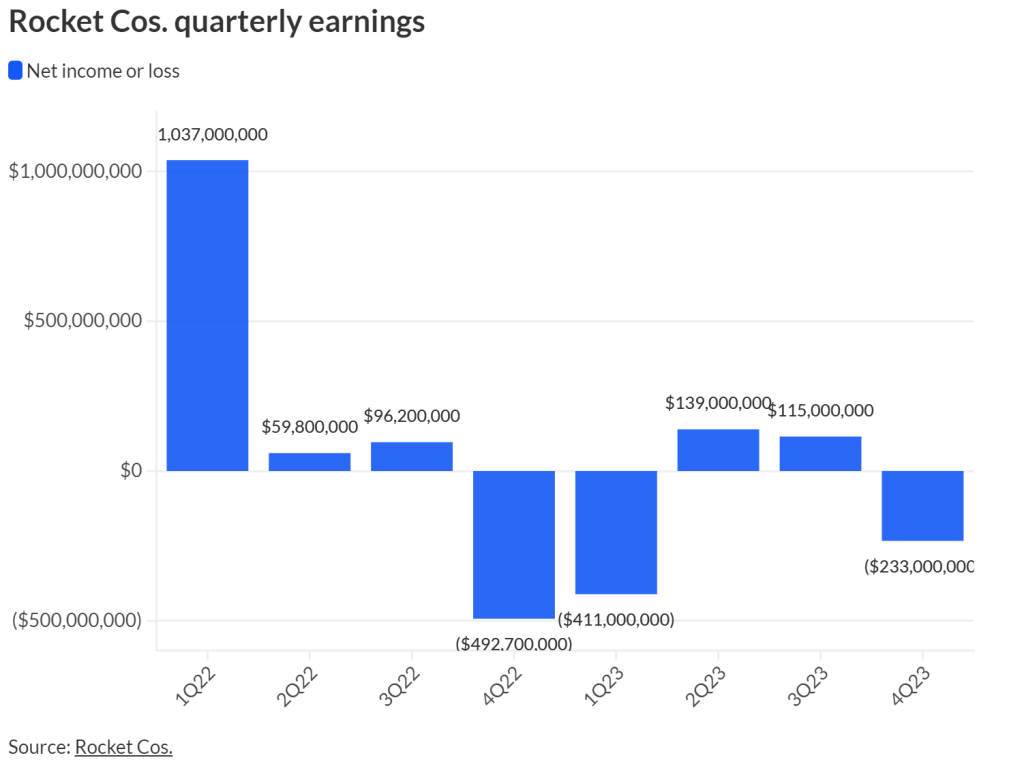

Seems the mortgage business is getting pretty sketchy. We can check out Rocket recent results

National Mortgage News reports Rocket had a bad Q4: https://www.nationalmortgagenews.com/news/rocket-companies-posts-233-million-net-loss-in-q4

Rocket posts $233 million net loss in 4Q

By Andrew MartinezFebruary 22, 2024, 7:07 p.m. EST

Rocket Cos. lost $233 million in the final months of 2023, sending its full-year mark deep into the red.

Executives for the Detroit-based giant Thursday touted the firm’s artificial intelligence bona fides and cost-cuttiing amid its step back in quarterly and annual performance. The company, which had predicted a difficult period, saw net income fall from $114.9 million in the third quarter, but improved on its $492.6 million net loss to close 2022.

The fourth quarter of 2023 pushed Rocket’s net loss for the year to $390 million, also a major step back from the $699.9 million profit it reported amid the market’s downswing at the end of 2022. Rocket posted adjusted net revenue of $885 million in the fourth quarter – a figure above guidance that Chief Financial Officer and Treasurer Brian Brown attributed to stronger origination metrics.

“We delivered these achievements in what was one of the worst quarters for mortgage origination in recent history,” he said in a conference call Thursday evening.

Rocket Mortgage counted total origination volume of $17.2 billion between last October and December, down 22% quarterly and 9% less than the same time in 2022. Over 2023, originations hit $78.7 billion, a steep decline from the $133 billion in volume in 2022.

Origination volume in the direct-to-consumer channel of $10.36 billion and in Rocket’s partner network, including Rocket Pro TPO, of $8.46 billion were down quarterly and year-over-year as well. Each channel also saw steep dips in volume compared to the same period last year.

Brown and CEO Varun Krishna in Thursday’s call emphasized Rocket’s cost-cutting, with annual expenses falling from $5 billion in 2022 to $4.2 billion in 2023. The business said it cut its project list by more than 80%, slashing or pivoting efforts including Rocket Auto and Rocket Solar for solar upgrade loans.

Rocket’s prominent AI focus is apparently giving it an edge in originations. In December, its underwriters didn’t have to intervene in nearly two-thirds of income verifications, a fivefold improvement compared to a year-and-a-half earlier, the company said.

“AI is something that you have to have a right to win. and a right to win means you have to have the assets,” said Krishna. “Because of those ingredients that we have at scale, It’s why we expect to be a benefactor.”

The lender’s gain on sale margin of 268 basis points was down from the third quarter’s 276 bps, but up from the 217 bps at the same time in 2022. Brown told an investor it was hard to say when the company would reach the 300 bps GOS margin of years past, but capacity exiting the market will help.

“Now we’re starting to actually see it flow through in terms of pricing competitiveness,” said Brown of industry capacity reductions.

Rocket held $6.4 billion of mortgage servicing rights at the end of the year, a number that’s dipped slightly over the past five quarters. The company is actively bidding on MSRs, and Brown said the supply isn’t great amid aggressive bids by other industry players.

The CFO also expressed confidence in Rocket regarding recent comments by Treasury Secretary Janet Yellen suggesting a nonbank lender could fail amid market stress. Rocket’s balance sheet and liquidity of $9 billion are among, if not, the strongest in the industry.

“It’s something we’ll pay close attention to, but in a lot of cases, new regulations like this could actually increase our competitive advantage and sometimes even increase the moat around this business,” he said.

****************************************

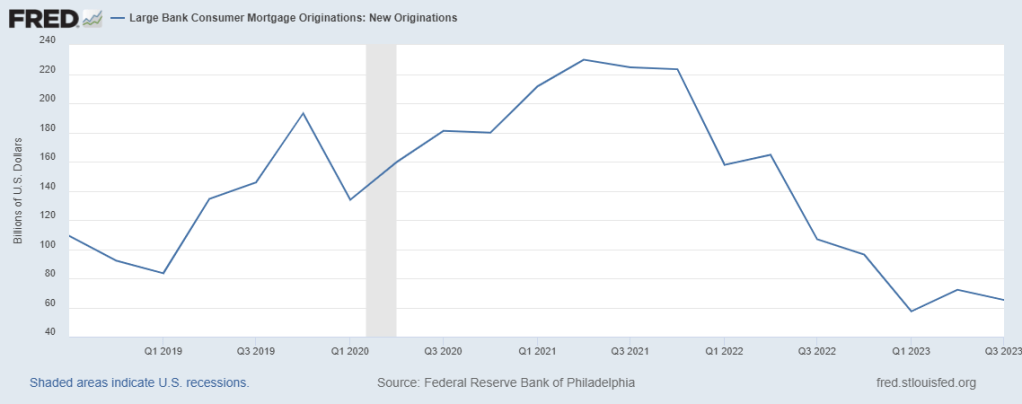

To put Rocket in context, consider some market trends.

The 30-year fixed rate mortgage is up 2x since 2021. And not going anywhere until Powell cuts rates which seems like “not for a while.”

Originations?

When I reported to my boat way back when, Rocket Man was on our sound track. I’m not an Elton fan but the line still resonates from standing a lot of otherwise quiet backwatches.

“All the science I don’t understand, it’s just my job 5 days a week.”