Abstract:

Citation:

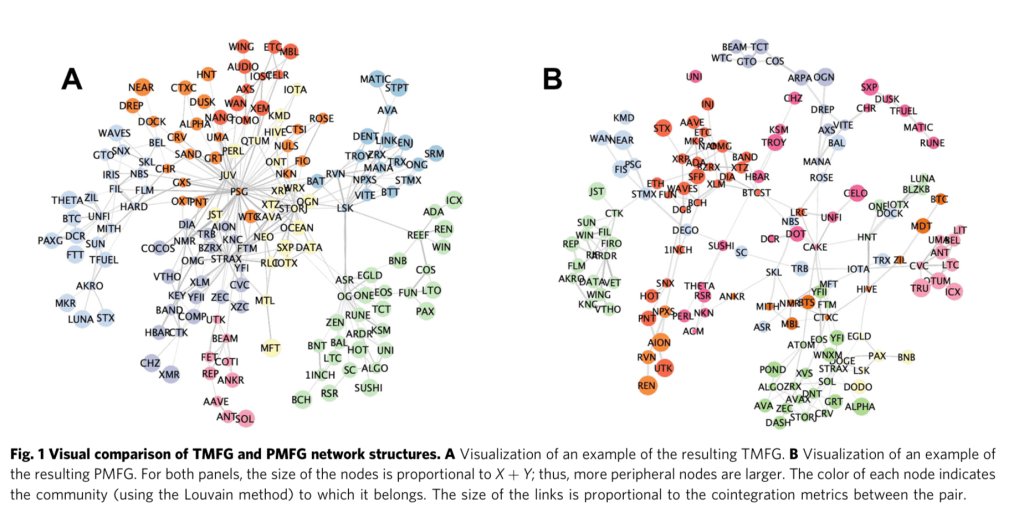

Diversification is the cornerstone of risk-adjusted portfolio construction. Yet, despite being a well-established principle in finance, diversification has been overlooked in pairs trading strategies, which often focus solely on selecting the most cointegrated pairs in isolation from the broader market structure and without accounting for their combined behavior within a portfolio. Here, we address this gap by introducing a network science framework to construct diversified pairs trading portfolios with minimal risk exposure, using cryptocurrencies as a case study. Our approach builds the structural network of assets based on their cointegration and then applies the Planar Maximally Filtered Graph and Triangular Maximally Filtered Graph to extract an effective market representation, which provides the essential market map for constructing diversified, risk-optimized portfolios. We show that selecting pairs that bridge communities significantly increases portfolio risk and reduces the average returns, as these pairs exhibit less stable long-term relationships because they are influenced by different market dynamics. Conversely, selecting peripheral pairs enhances the overall portfolio performance, consistently outperforming the conventional pairs trading approach of selecting the top cointegrated pairs. Finally, we conclude that incorporating the market network structure where pairs are embedded is essential for building diversified portfolios that mitigate hidden risks and cascading failures.

Mar Grande & Javier Borondo (2025) Link: https://doi.org/10.1057/s41599-025-05661-7

Contemporary risk management and regulatory policies seek to blunt the “too big to fail” hubris – a mindset said to be the ignition point for the Great Financial Crisis. To guard against increased risk from undue concentration, policies seek to diversify exposure by building connections.

Network science and statistical physics teaches cascading failures of all kinds can also arise from a “too connected to fail” dynamic.

In fact, be it a “too big to fail” network component, or a a “too connected to fail” community, cascading events can be two edges of the same sword.

In this paper, Grande & Borondo (2025) report selecting pairs that bridge ticker communities significantly increases portfolio risk and reduces the average returns. Such pairs exhibit less stable long-term relationships because they are influenced by different market dynamics.

Network-based approaches to portfolio diversification has been a rapidly growing part of the literature over the past decade. Network approaches reduce concentration risk (“too big to fail”), leading to more balanced and lower-risk portfolios.

In this paper, Grande & Borodono demonstrate incorporating the network structure rather than relying solely on pairwise co-movement metrics can guide the construction of more resilient pairs trading portfolios with a high concentration of peripheral pairs, thereby reducing exposure to cascading failures.