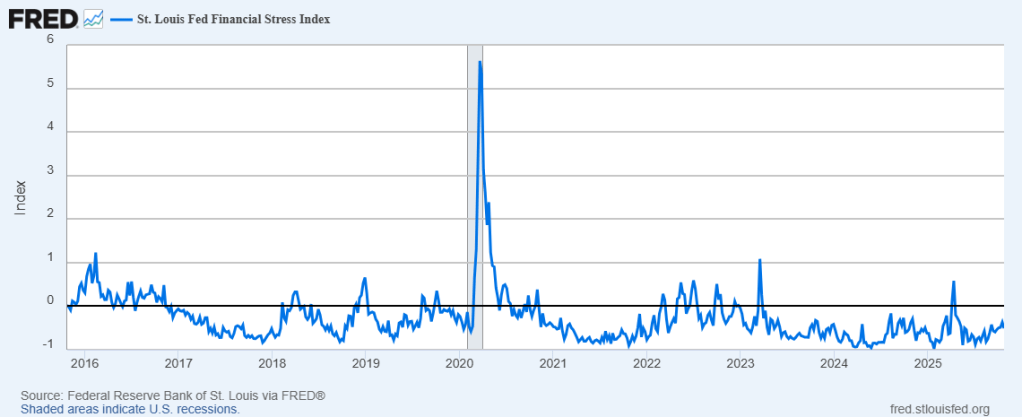

Market chatter seems to be rising reflecting growing fears credit market stress is ascending as Treasury yields fall and other economic warning signs are lighting up.

Manufacturing data and labor markets are retreating and the Fed is shutting down its QT policy ahead of possible rate cuts.

A bank liquidity crisis occurs when a bank lacks sufficient cash or other highly liquid assets to meet its short-term financial obligations, such as sudden large withdrawals by depositors. This can happen because banks often fund long-term assets like loans with short-term liabilities like deposits, creating a maturity mismatch. If many depositors withdraw their funds at once, a bank run can occur, and the bank may be forced to sell assets at a loss to cover the withdrawals, potentially leading to failure.

This dynamic is not restricted to banks. Long-dated capital projects in the energy sector can experience similar systemic risk where funding investments assumes demand is sufficient to recover project costs.

Following the Great Financial Crisis, network science literature has explored cascading dynamics among financial instituations. Among other things, the literature compares the stability of ring and complete network structures and shown completely connected systems tend to be be stable under small shocks but give way to instability under large shocks. In contrast, ring networks tend to be more resilient under large shocks while less so under smaller disruptions.

Fire sales and default contagion dynamics are the principal vectors are two of the main drivers of systemic risk in financial networks. Contagion reflects direct balance sheet exposures between institutions while the consequential fire sales reprices asset valuations thereby transmitting distress throughout the financial system.

Detering et al. (2020) develop a model explaining the joint effect of the two contagion channels and investigatea structures of financial systems that promote or hinder the spread of an initial local shock. They characterize resilient and non-resilient system structures by criteria that can be used by regulators to assess system stability. Further, they provide explicit capital requirements that secure the financial system against the joint impact of fire sales and default contagion.

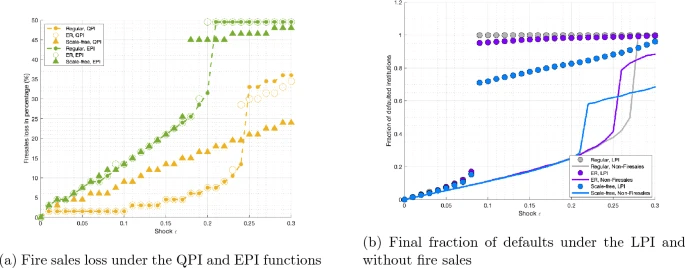

Amini et al (2025) builds on Detering and presents a framework to better understand the joint impact of fire sales and default cascades on systemic risk in complex financial networks. They quantify quantify how price-mediated contagion across institutions with common asset holdings can worsen cascades of insolvencies in a heterogeneous financial network during a financial crisis. In the numerical studies we investigate the effect of heterogeneity in network structure and price impact function on the final size of the default cascade and fire sales loss.

System or network models typically segments into 3 categories:

- Regular networks (without network heterogeneity)

- Erdös-Rényi (ER) random networks with low heterogeneity when institutions have a degree (i.e., connections with other entities) close to the average degree

- Scale-free networks (with high heterogeneity)

Amini modeled financial institutions in these ways and tested the resulting dynamics following a range of shocks.

With exponential price impacts, Aminim observed small shocks below the critical shock value for the scale-free network. Network heterogeneity does not have a significant influence on the fire sales loss.

For the quadratic price impact, small shocks trigger larger fire sale losses in the scale-free network.

Networks with higher heterogeneity has a smaller critical value for the shock. When the shock exceeds the critical value for the regular network , the regular network has the largest fire sales loss, while the scale-free network has the smallest loss. This dynamic arises because the scale-free network, has a larger proportion of institutions with low degrees (such as 1 and 2), which have a higher chance of surviving after a large shock. This makes the scale-free network more resilient to a large shock compared to the other two networks.

Aminimi observes their simulations highlight the importance of ensuring that a financial network can withstand large cascades under stress scenarios that put pressure on specific characteristics such as capital or liquidity reserves.

Presently, there is little evidence banking regulations capture these dyanmics.

____________________________________________

Amini, H., Cao, Z. & Sulem, A. Fire sales, default cascades and complex financial networks. Math Finan Econ 19, 225–260 (2025). https://doi.org/10.1007/s11579-024-00381-z

Detering, N., Meyer-Brandis, T., Panagiotou, K. et al. An integrated model for fire sales and default contagion. Math Finan Econ 15, 59–101 (2021). https://doi.org/10.1007/s11579-020-00273-y