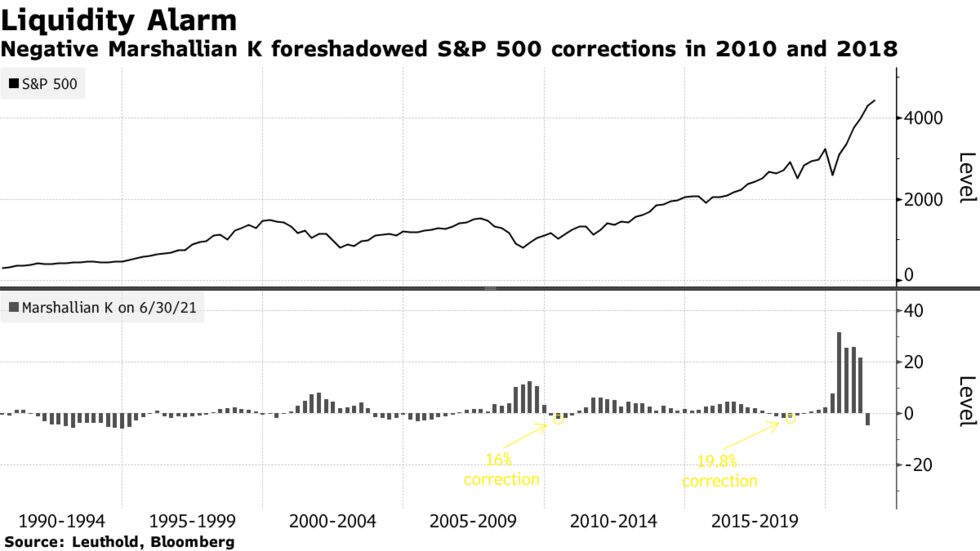

Excess liquidity is the ratio of a monetary aggregate to nominal GDP. It is often referred to as the “Marshallian K”, which is equivalent to the inverse of the “velocity of money.”

The Marshallian K fell below zero in 2010, a year when the S&P 500 Index suffered a 16% correction. A similar dip in 2018 portended a selloff that almost killed that bull market.

The indicator went negative faster than ever.

Here is Bloomberg on the prospect of rain.