Prometheus Shrugged: https://prometheusshrugged.substack.com/p/edificewrecks

Mutually Assured Corruption

I’ve long sought to avoid the COVID-19 vaccine debate, because there are plenty of voices on either side, and there are many other facets of the tragedy that have been largely ignored. However, recent events & discoveries have compelled me to temporarily set my neutrality aside. The large-scale implementation of vaccine mandates, within the context of the findings of my extensive research,

It is indisputable that the mRNA vaccines have saved thousands of lives, and I gladly received the Moderna jabs because it was the best thing I could do to protect my vulnerable parents. It is also increasingly clear that the efficacy of the mRNA vaccines is declining, and that the Biden administration is ignoring this trend and doubling down on the vaccine strategy through ever-widening mandates.

No one on Earth was more qualified to make judgments on the utility of CoV vaccines than Dr. Fauci and his NIAID. They could not have not known the risks. What they didn’t know – or didn’t mention – was that DARPA was on the record as having rejected a similar proposal in bats just 3 months before the contract was signed for MERS-CoV/pan-CoV vaccine development, with the same spike ‘active ingredient.’

I’d bet that most people wouldn’t be so enthusiastic about the ‘science’ if they knew that basic animal trials for proof-of-concept involving spike proteins for immune response were rejected by DARPA in 2018, only to be gambled on out of necessity because of the pandemic. I’m not trying to imply that the issue isn’t complex; my concern is that our government is literally working to censor vital public discussions about those complexities.

Mandating mass vaccination while using a Supreme Court ruling from 1905 as a precedent [one that upholds state authority for mandates, not federal], in the midst of unconstitutional undermining of 1st, 9th, 10th & 14th Amendment rights, is disgusting. Further, mandates that involve censorship to prevent discussion on the specific efficacy and risks of the mandated prophylactic cannot possibly be constitutional – and will destroy the public’s trust in the motives of its leaders.

As it should.

1-Allegory of the Depraved

In my most-read article, Who watches the Watchmen?, the answer to the titular question was nobody. It’s depressingly obvious that scientists [and virologists in particular] have conducted much of their research under the intentionally blind eye of the American scientific establishment. Each new release of FOIA emails has piled on further evidence of scientists intentionally publishing propaganda designed to smother any academic research into a non-natural origin story for the virus that causes COVID-19.

2 weeks ago, the investigative group DRASTIC published an analysis of a proposed research project that EcoHealth Alliance submitted to DARPA as a bid to join their PREEMPT program in 2018. I can speak with some authority about their analysis because I’m a member of DRASTIC – and I helped write our report, including much of the introduction. I’ve since realized that the implications of the proposal in regards to US vaccine policy have been missed, and therefore it’s important to address them specifically.

What is DRASTIC?

DRASTIC’s the sort of tongue-in-cheek acronym that one would never have expected to one day represent the leading edge of the global search for the origins of the COVID-19 pandemic. At the same time, it’s a perfect metaphor for the intense, pragmatic approach that must be taken to address both the pandemic and the structural erosion of a scientific establishment that sacrificed objectivity in an attempt to maintain the illusion of control.

Our collection of scientists and researchers have published more than 80 peer-reviewed papers, pre-prints and articles related to the origins of the COVID-19 pandemic, but the PREEMPT analysis is the first publication to be released by DRASTIC as a full group.

U.S. Representative Mike Gallagher, of Wisconsin, released an excellent 7-minute video that summarizes key findings from DRASTIC’s analysis of these documents. In order to save space in this post, I highly encourage readers to take a few minutes to watch this or one of the other videos linked below. My focus for this article is to explain elements that haven’t been discussed elsewhere:

[DRASTIC’s momentum continues to grow; in the last few days, the New York Post wrote about our letter calling for Peter Daszak to resign as president of EcoHealth Alliance [EHA, the non-profit that funneled money from NIH grants to the Wuhan Institute of Virology] & the House of Representatives added an amendment ending federal funding for EHA]

2-“This isn’t Strategy – this is just Tactics”

The COVID pandemic has killed more than 675,000 Americans since March, 2020, and it has upended the rhythm of daily life in ways that we are still adapting to 18 months later. Only recently, however, has the pandemic itself begun to feel truly pervasive – as the ages of the sick and dying have lowered – as a result of the ‘delta’ variant.

There are many factors that have contributed to the global delta wave, but at its core the variant’s success is a function of its exponentially greater production of infective particles, which has simply overwhelmed the immune systems of the young whom are less susceptible than those of their parents and grandparents. Another factor is that children under 12 have been unable to get vaccinated because of the approved age limit. My own perspective is that the dynamic is fueled, at least in part, by highly effective aerosol transmission, in which case our current mitigation protocols are potentially exacerbating the evolution and spread of the delta variant.

I spent the first year of the pandemic analyzing the epidemiological data in the United States, in an effort to use my prior to experience to educate others about what was happening, and what to expect. Recently, I paused my DRASTIC work for a day to catch up on the latest numbers, and I mixed in vaccine data so that I could see for myself what has been unfolding behind the rhetoric on both sides.

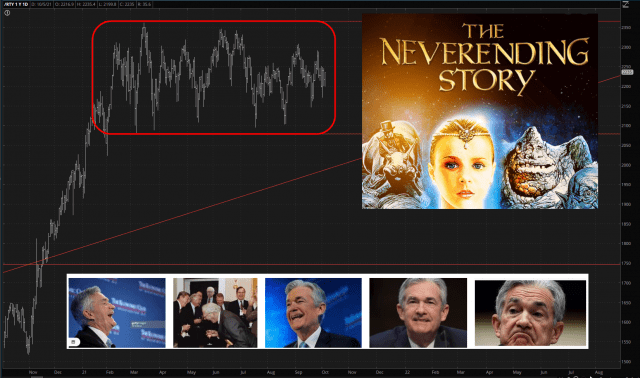

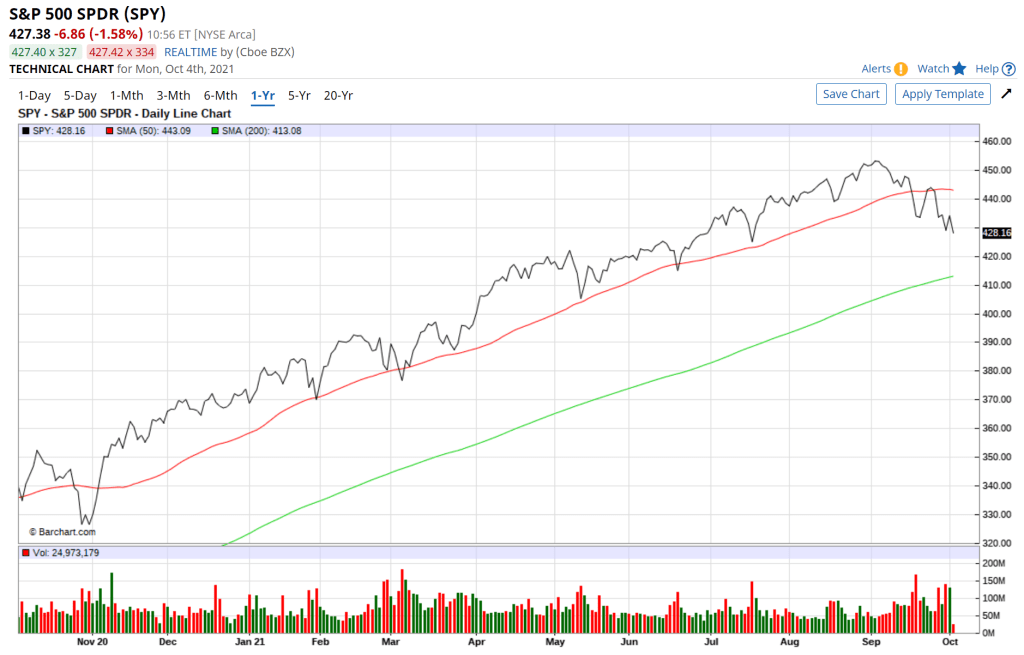

More complete discussions of this phenomenon on my Twitter feed, but the main theme is that case fatality rates [CFR’s] since May 1st are losing their previously strong negative correlation with state population vaccination proportions. 4 of the states pictured above actually have higher CFR’s during the delta wave than in the pandemic overall, which is in opposition to the prevailing trends throughout the last 20 months. The discrepancy is much bigger than any state’s case trends can account for [CFR’s fall when cases surge, because deaths are a lagging metric].

[see also: breakdown of vaccine escape from the FDA’s recent Pfizer booster hearing]

3-Sterilizing Impunity

Science is mandating their band-aids – for us – to cover up their self-inflicted gunshot wound. If the public knew that the DOD had rejected a similar type of research on BATS, 3 months before moving forward with initial vaccine research for humans, they might be concerned. Below is the relevant section from the PREEMPT proposal:

There was no justifiable reason to extensively fiddle with human immune comparisons for this self-disseminating bat vaccine meant to suppress emergence of SARS-like CoVs. EcoHealth Alliance and the Wuhan Institute of Virology [WIV] already knew enough to target bats without working with human/primate cells as well, because extensive work creating chimaeric viruses to test the human threat of bat coronaviruses in the wild was a large part of what the WIV and UNC-Chapel Hill had been experimenting with for several years.

Which is a good reason to question the necessity of those experiments. But…

The overlooked key finding (in my opinion) is the epitope coverage aspect of the rejection, within the first paragraph. Epitope coverage is key in the development of effective vaccines; it’s the scientific term for how much of a target virus’s genome is included in a vaccine’s ‘active ingredient’ [the genetic material of the targeted virus/viruses, however attenuated]; guessing next year’s mixture of dominant flu strains is how our annual flu vaccines are chosen and produced. The efficacy of flu vaccines is partly determined by how good scientist’s projections are, but our familiarity with flu vaccines has made it easy for the public to overlook what scientists already know – that coronaviruses work quite differently.

Viral quasispecies ‘swarms’, as D. Sirotkin pointed out, are an unknown feature of many viruses amongst the public. I certainly had never heard of the phenomenon prior to researching COVID-19.

The NIH, on the other hand, knows more about this phenomenon than any other public institution on Earth; for more than a decade Dr. Fauci’s NIAID has partnered with [funded] many of the world’s best coronavirologists, and the Vaccine Research Center within the NIAID shares many of the mRNA patents used to produce the Moderna COVID-19 vaccine.

Here’s the rub: the current mRNA vaccines are designed as quick-response platforms for pandemic emergencies. Dr. Fauci’s primary focus in this regard has been a universal flu vaccine, and thus far mRNA is still a pandemic-centered technology. In 2018, they expanded this program to include MERS-COV and a general pan-CoV vaccine. As I wrote within our PREEMPT analysis, the new oversight panel known as the P3CO was HHS’s way of carving out an exemption for the gain-of-function work needed for their coronavirus vaccine research.

There’s just one problem, which some observers have been pointing out for years – the recombination/quasispecies elements of CoV variant evolution is less optimal for a partial-coverage epitope [see sterilizing immunity] strategy than for other viruses, especially since the part they specifically target and use in their vaccines is (obviously) the spike that drives infectivity. The DARPA program director knew enough to know that EHA’s proposal was of questionable value under these conditions, even if he may have been curious himself about what the data might show. Therefore, it only makes sense that he would decline a project that didn’t show as much promise in the specific area covered under the proposal. It’s also not surprising that no one has bothered to admit the existence of this proposal.

[additional related resources: aerosol transmission; CDC’s latest guidance on transmission; designing effective transmissible vaccines; vaccine dev.; ‘animal trials’ for the mRNA vaccines;supporters; opponents[1:14 – end];back-and-forth concerning theefficacy of a 3rd Pfizer shot [booster]; Public Health or Power Play?; Israel Data]

4-Pandora’s Pox: Censorship

Dr. Fauci’s enthusiastic support of censorship during the last 20 months begins to make a little more sense after you consider that the scientific establishment he holds unofficial sway over was heavily involved in research that has a statistically significant chance of playing a role in the emergence of SARS-CoV-2. In February, I broke the story that Fauci appeared to be directly directly involved in the development of a natural-origin narrative and the censorship that worked to prevent research into an alternative hypothesis; every release of FOIA documents since has simply added evidence in support of that claim.

Fauci also worked with the presidential science advisor, Kelvin Droegemeier, to keep information regarding these compromising connections from becoming known – including from President Trump and his national security team. Instead, Fauci demonized efforts to question all of it, including DRASTIC’s work that sought to uncover what was happening in Wuhan. He’s been demonizing Americans and forcing them to accept the vaccines that he knows are a stop-gap measure at best, and whose long term effects are completely unknown. He’s been defended by the same group of scientists justifying ostracism and calling for questioning science to be a hate crime.*

[*Peter Hotez, of course, has been conducting research for the VRC’s CoV vaccines for a decade]

You can’t get much sicker than blaming innocent people for the problems you may have created and worked extensively to prevent public awareness of the incriminating links. But that’s where we are today.

*Scientific censorship resources and references: 100K pages of FOIA emails condensed down to 173, a timeline of censorship, my public spreadsheet with 798 sources – & 1 particular tab that shows the results of my analysis of the impact of Fauci’s censorship.*

5-Deformed Consent: Mandates

I’ve often referenced Prometheus, Pandora and Plato’s Allegory of the Cave in my analyses of COVID-19, like many others. But, perhaps the best Greek metaphor for ‘Science’ is the Ring of Gyges, which can also be found within Plato’s Republic.

The story centers on a ring that, when worn, makes its bearer invisible to others, much like the One Ring that Frodo bears throughout the Lord of the Rings. Extended use of the ring invariably corrupts the soul. Are we not witnessing the result of unquestioned faith in scientists, writ large? How else can rational men come to believe that questioning the blatant suppression of potentially damaging evidence should be considered a hate crime?

The correct answer to the pandemic is not to grant further immunity to undeserved scientific arrogance. The correct answer to the pandemic is to hold anyone and everyone accountable, based on an open and exhaustive inquiry. No constitutionally questionable proclamations should EVER be based on the guidance of those whose actions may have precipitated the crisis itself.

Translation: Using Supreme Court rulings [i.e. 1905] that predate the discovery of antibiotics as precedent for mandating mRNA vaccines is unfounded, at best. At worst, it is unconscionable to force compliance for a vaccine mechanism for which animal trials were rejected 3 years ago.

Having fought for freedom overseas, I cannot stand silent as mandates and censorship destroy our liberties here at home, regardless of any justifications related to the pandemic. The victims of the pandemic deserve justice, and every additional day that the majority in Congress delays any and all investigations into its origins ensures another day of countless American lives being lost.

Encouraging mandated compliance without exhibiting integrity is disgusting, and a betrayal of the public trust. Should the same scientists be found in some measure to have been complicit in conducting experiments that later resulted in a lab release, the intentional tearing apart of our society wouldn’t be disgusting – it would be horrific.

No cause is so righteous that it supersedes the rights of those it purports to defend.

As I wrote in July:

The COVID-19 pandemic has manifestly proven that there is no lie so ‘noble’ that it overrides the rights and wisdom of a free and informed public. That doesn’t mean that the public will inherently do better.

It’s just acknowledging the inescapable conclusion – that we can’t possibly do worse.

C. H. Rixey