China Joe – fighting for “Da People.”

Babylon Bee Exclusive: https://babylonbee.com/news/cartels-give-biden-another-human-trafficker-of-the-month-award

WASHINGTON, D.C.—A group of cartel members presented Joe Biden with its prestigious “Human Trafficker of the Month” award today, marking the third month in a row the new president has received the award.

Democrat presidents are constant recipients of the honor, usually winning the award many dozens of times throughout their time in office, and Biden appears to be no exception so far. The award honors an individual who does a great job at ensuring that thousands more children and vulnerable Central American and Mexican residents will be smuggled across the border each and every day. The cartel cited Biden’s immigration policies and disastrous handling of the border crisis as key factors in their decision to give the award to him once again.

“El Presidente Biden es muy bueno!” said one narco as he handed Biden the plaque. “We thank you, Mr. Preisdent, for your lax border policies and promises of free money for migrants that is allowing us to smuggle them across the border in record numbers. You are truly a friend to the cartel.” The drug kingpin then pulled out his revolver and fired it into the air, a custom that represents bestowing honor and praise upon an individual in the cartel community — usually reserved for drug dealers who have an exceptionally good month.

Biden thanked them for the award and then got his phone out to play “Despacito” in their honor.Texas Governor Orders New Arrivals From California To Quarantine For 30 Years.

Y ahora aquí hay una canción de celebración en honor a “China Joe”.

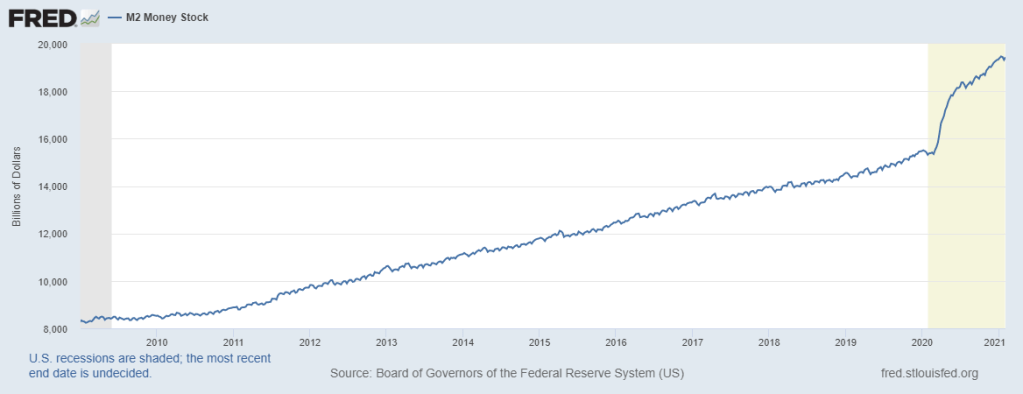

As of February 1, 2021, the US money supply (“M2”) was $19,432.4 million – call it $19.4 trillion. That’s up ~$4 trillion YoY or ~26% YoY.

Remember that mark – a 26% YoY increase in the money supply against a GDP that declined ~1% YoY.

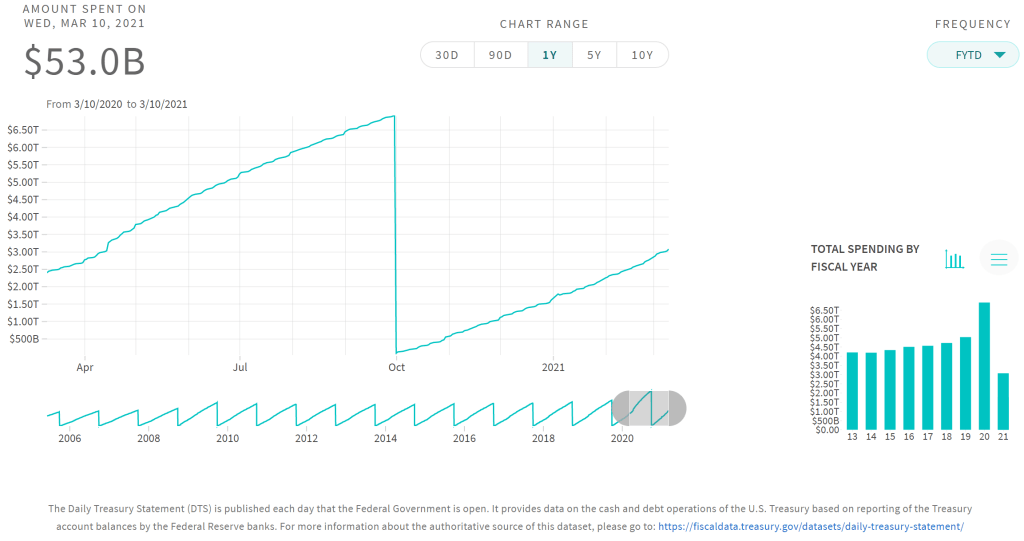

And while you’re remembering consider, daily Federal spending closed out the week at $53 billion compared to $39.3 billion a year ago.

That’s a 34% increase YoY. So, more to come.

All that before the $1.9 trillion in the American Rescue Plan Act.

Party on, Wayne.

As discussed in Bloomberg: https://www.bloomberg.com/news/articles/2021-03-08/u-s-bond-traders-stung-by-selloff-eye-inflation-data-auctions

“The 10-year and 30-year auctions on Wednesday and Thursday will be closely watched as litmus tests, with weak demand likely adding fuel to bearish sentiment,” TD Securities Inc. rates strategists Gennadiy Goldberg and Priya Misra in New York, wrote in a note to clients published Monday. “Note that the cheapening of 10s — outright and on the curve — suggests some auction setup.”

What’s to like? Primary dealers are loading up Treasures. Yet, nobody wants these dogs so they pile up on the balance sheet.

And every day, the paper boy brings more.

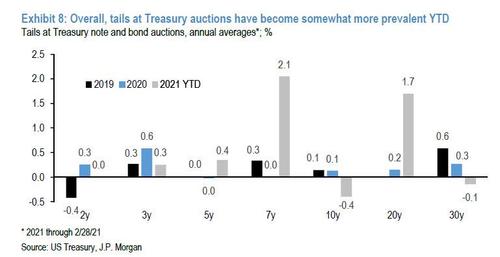

Recall barely bid 5- and 7- year note auctions last month thatdrove up benchmark 10-year yields above 1.60% – a in a year.

Tyler over at ZeroHedge covered JPM’s notes: https://www.zerohedge.com/markets/supply-has-become-difficult-absordb-jpmorgan-issues-stark-warning-about-us-treasury.

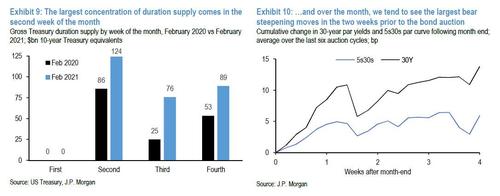

JPMorgan rates strategist Jay Barry issued a rather ominous warning, and in a note titled “How are outsized changes in issuance impacting auction dynamics?” (available to pro subs in the usual place) he points out that Treasury supply has gotten increasingly more difficult to absorb (and that’s even with the Fed monetizing $80BN in Treasurys every month).

Consider this –

At the same time, buyside demand in the primary market is fading particularly in 5- and 7-year notes and 20-year bonds.

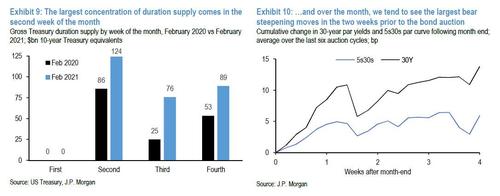

And this is particularly evident in the second week of the month. Like right now amidst a $24 billion offering this month.

Lately, the market has been inhaling duration at a doubled rate.

“Thus with dealers absorbing more than double the duration per month than it did a year ago via the auction, but not warehousing more risk, this is perhaps driving the more variable auction results we’ve seen in recent months.”

According to Bloomberg, BNP Paribas SA is among the banks forecasting the 10-year yield will reach 2% by year-end, but “absolutely there’s a risk that this could happen much quicker,” said Shahid Ladha, head of Group-of-10 rates strategy in New York. “Everything seems to be pointing to a faster pace and bigger magnitude of repricing because the reopening of the U.S. economy and fiscal impulse are surprising to the upside.”

This should be interesting.

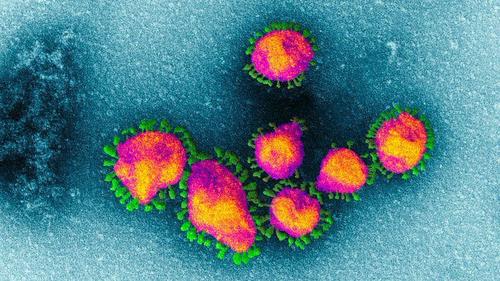

About a year ago, leaders of the Democrat Socialist Party, including the Sock Puppet President, screamed “racism” when then-President Trump belatedly closed the border on China.

Things got testier when Trump suggested the Wuhan Institute of Virology (WIV) presented a “smoking gun” at the crime scene.

So now here we are a year later with a story in the leftist-aligned Politico by Josh Rogin spelling out Dr. Anthony Fauci was paying for gain-of-function research at WIV: https://www.politico.com/news/magazine/2021/03/08/josh-rogin-chaos-under-heaven-wuhan-lab-book-excerpt-474322

In 2018, Diplomats Warned of Risky Coronavirus Experiments in a Wuhan Lab. No One Listened.

On January 15, in its last days, President Donald Trump’s State Department put out a statement with serious claims about the origins of the Covid-19 pandemic. The statement said the U.S. intelligence community had evidence that several researchers at the Wuhan Institute of Virology laboratory were sick with Covid-like symptoms in autumn 2019—implying the Chinese government had hidden crucial information about the outbreak for months—and that the WIV lab, despite “presenting itself as a civilian institution,” was conducting secret research projects with the Chinese military. The State Department alleged a Chinese government cover-up and asserted that “Beijing continues today to withhold vital information that scientists need to protect the world from this deadly virus, and the next one.”

The exact origin of the new coronavirus remains a mystery to this day, but the search for answers is not just about assigning blame. Unless the source is located, the true path of the virus can’t be traced, and scientists can’t properly study the best ways to prevent future outbreaks.

The original Chinese government story, that the pandemic spread from a seafood market in Wuhan, was the first and therefore most widely accepted theory. But cracks in that theory slowly emerged throughout the late winter and spring of 2020. The first known case of Covid-19 in Wuhan, it was revealed in February, had no connection to the market. The Chinese government closed the market in January and sanitized it before proper samples could be taken. It wouldn’t be until May that the Chinese Centers for Disease Control disavowed the market theory, admitting it had no idea how the outbreak began, but by then it had become the story of record, in China and internationally.

In the spring of 2020, inside the U.S. government, some officials began to see and collect evidence of a different, perhaps more troubling theory—that the outbreak had a connection to one of the laboratories in Wuhan, among them the WIV, a world leading center of research on bat coronaviruses.

To some inside the government, the name of the laboratory was familiar. Its research on bat viruses had already drawn the attention of U.S. diplomats and officials at the Beijing Embassy in late 2017, prompting them to alert Washington that the lab’s own scientists had reported “a serious shortage of appropriately trained technicians and investigators needed to safely operate this high-containment laboratory.”

But their cables to Washington were ignored.

When I published the warnings from these cables in April 2020, they added fuel to a debate that had already gone from a scientific and forensic question to a hot-button political issue, as the previously internal U.S. government debate over the lab’s possible connection spilled into public view. The next day, Trump said he was “investigating,” and Secretary of State Mike Pompeo called on Beijing to “come clean” about the origin of the outbreak. Two weeks later, Pompeo said there was “enormous evidence” pointing to the lab, but he didn’t provide any of said evidence. As Trump and Chinese President Xi Jinping’s relationship unraveled and administration officials openly blamed the Wuhan lab, the U.S.-China relationship only went further downhill.

As the pandemic set in worldwide, the origin story was largely set aside in the public coverage of the crisis. But the internal government debate continued, now over whether the United States should release more information about what it knew about the lab and its possible connection to the outbreak. The January 15 statement was cleared by the intelligence community, but the underlying data was still held secret. Likely changing no minds, it was meant as a signal—showing that circumstantial evidence did exist, and that the theory deserved further investigation.

Now, the new Joe Biden team is walking a tightrope, calling on Beijing to release more data, while declining to endorse or dispute the Trump administration’s controversial claims. The origin story remains entangled both in domestic politics and U.S.-China relations.Last month, National security adviser Jake Sullivan issued a statement expressing “deep concerns” about a forthcoming report from a team assembled by the World Health Organization that toured Wuhan—even visiting the lab—but was denied crucial data by the Chinese authorities.

But more than four years ago, long before this question blew up into an international point of tension between China and the United States, the story started with a simple warning.

***

In late 2017, top health and science officials at the U.S. Embassy in Beijing attended a conference in the Chinese capital. There, they saw a presentation on a new study put out by a group of Chinese scientists, including several from the Wuhan lab, in conjunction with the U.S. National Institutes of Health.

Since the 2002 outbreak of SARS—the deadly disease caused by a coronavirus transmitted by bats in China—scientists around the world had been looking for ways to predict and limit future outbreaks of similar diseases. To aid the effort, the NIH had funded a number of projects that involved the WIV scientists, including much of the Wuhan lab’s work with bat coronaviruses. The new study was entitled “Discovery of a Rich Gene Pool of Bat SARS-Related Coronaviruses Provides New Insights into the Origin of SARS Coronavirus.”

These researchers, the American officials learned, had found a population of bats from caves in Yunnan province that gave them insight into how SARS coronaviruses originated and spread. The researchers boasted that they may have found the cave where the original SARS coronavirus originated. But all the U.S. diplomats cared about was that these scientists had discovered three new viruses that had a unique characteristic: they contained a “spike protein” that was particularly good at grabbing on to a specific receptor in human lung cells known as an ACE2 receptor. That means the viruses were potentially very dangerous for humans—and that these viruses were now in a lab with which they, the U.S. diplomats, were largely unfamiliar.

Knowing the significance of the Wuhan virologists’ discovery, and knowing that the WIV’s top-level biosafety laboratory (BSL-4) was relatively new, the U.S. Embassy health and science officials in Beijing decided to go to Wuhan and check it out. In total, the embassy sent three teams of experts in late 2017 and early 2018 to meet with the WIV scientists, among them Shi Zhengli, often referred to as the “bat woman” because of her extensive experience studying coronaviruses found in bats.

When they sat down with the scientists at the WIV, the American diplomats were shocked by what they heard. The Chinese researchers told them they didn’t have enough properly trained technicians to safely operate their BSL-4 lab. The Wuhan scientists were asking for more support to get the lab up to top standards.

The diplomats wrote two cables to Washington reporting on their visits to the Wuhan lab. More should be done to help the lab meet top safety standards, they said, and they urged Washington to get on it. They also warned that the WIV researchers had found new bat coronaviruses could easily infect human cells, and which used the same cellular route that had been used by the original SARS coronavirus.

Taken together, those two points—a particularly dangerous groups of viruses being studied in a lab with real safety problems—were intended as a warning about a potential public-health crisis, one of the cable writers told me.They kept the cables unclassified because they wanted more people back home to be able to read and share them, according to the cable writer. But there was no response from State Department headquarters and they were never made public. And as U.S.-China tensions rose over the course of 2018, American diplomats lost access to labs such as the one at the WIV.

“The cable was a warning shot,” one U.S. official said. “They were begging people to pay attention to what was going on.” The world would be paying attention soon enough—but by then, it would be too late.

The cables were not leaked to meby any Trump administration political official, as many in the media wrongly assumed. In fact, Secretary of State Pompeo was angry when he found out about the leak. He needed to keep up the veneer of good relations with China, and these revelations would make that job more difficult. Trump and President Xi had agreed during their March 26 phone call to halt the war of words that had erupted when a Chinese diplomat alleged on Twitter that the outbreak might have been caused by the U.S. Army. That had prompted Trump to start calling it the “China virus,” deliberately blaming Beijing in a racist way. Xi had warned Trump in that call that China’s level of cooperation on releasing critical equipment in America’s darkest moment would be jeopardized by continued accusations.

After receiving the cables from a source, I called around to get reactions from other American officials I trusted. What I found was that, just months into the pandemic, a large swath of the government already believed the virus had escaped from the WIV lab, rather than having leaped from an animal to a human at the Wuhan seafood market or some other random natural setting, as the Chinese government had claimed.

Any theory of the pandemic’s origins had to account for the fact that the outbreak of the novel coronavirus—or, by its official name, SARS-CoV-2—first appeared in Wuhan, on the doorstep of the lab that possessed one of the world’s largest collections of bat coronaviruses and that possessed the closest known relative of SARS-CoV-2, a virus known as RaTG13 that Shi identified in her lab.

Shi, in her March interview, said that when she was first told about the virus outbreak in her town, she thought the officials had gotten it wrong, because she would have guessed that such a virus would break out in southern China, where most of the bats live. “I had never expected this kind of thing to happen in Wuhan, in central China,” she said.

By April, U.S. officials at the NSC and the State Department had begun to compile circumstantial evidence that the WIV lab, rather than the seafood market, was actually the source of the virus. The former explanation for the outbreak was entirely plausible, they felt, whereas the latter would be an extreme coincidence. But the officials couldn’t say that out loud because there wasn’t firm proof either way. And if the U.S. government accused China of lying about the outbreak without firm evidence, Beijing would surely escalate tensions even more, which meant that Americans might not get the medical supplies that were desperately needed to combat the rapid spread of SARS-CoV-2 in the United States.

Arkansas Senator Tom Cotton seemed not to have been concerned about any of those considerations. On February 16, he had offered a totally unfounded theory of his own, claiming on Fox News that the virus might have come from China’s biowarfare program—suggesting, in other words, that it had been engineered deliberately to kill humans. This wasn’t supported by any known research: To this day, scientists largely agree that the virus was not “engineered” to be deadly; SARS-CoV-2 showed no evidence of direct genetic manipulation. Furthermore, the WIV lab had published some of its research about bat coronaviruses that can infect humans—not exactly the level of secrecy you would expect for a clandestine weapons program.

As Cotton’s speculation vaulted the origin story into the news in an incendiary new way, he undermined the ongoing effort in other parts of the U.S. government to pinpoint the exact origins and nature of the coronavirus pandemic. From then on, journalists and politicians alike would conflate the false idea of the coronavirus being a Chinese bioweapon with the plausible idea that the virus had accidentally been released from the WIV lab, making it a far more politically loaded question to pursue.

***

After I published a Washington Post column on the Wuhan cables on April 14, Pompeo publicly called on Beijing to “come clean” about the origin of the outbreak and weeks later declared there was “enormous evidence” to that effect beyond the Wuhan cables themselves. But he refused to produce any other proof.

At the same time, some members of the intelligence community leaked to my colleagues that they had discovered “no firm evidence” that the outbreak originated in the lab. That was true in a sense. Deputy national security adviser Matthew Pottinger had asked the intelligence community to look for evidence of all possible scenarios for the outbreak, including the market or a lab accident, but they hadn’t found any firm links to either. But absence of evidence is not evidence of absence. There was a gap in the intelligence. And the intelligence community didn’t know either way.

Large parts of the scientific community also decried my report, pointing to the fact that natural spillovers have been the cause of other viral outbreaks, and that they were the culprit more often than accidents. But many of the scientists who spoke out to defend the lab were Shi’s research partners and funders, like the head of the global public health nonprofit EcoHealth Alliance, Peter Daszak; their research was tied to hers, and if the Wuhan lab were implicated in the pandemic, they would have to answer a lot of tough questions.

Likewise, the American scientists who knew and worked with Shi could not say for sure her lab was unconnected to the outbreak, because there’s no way they could know exactly what the WIV lab was doing outside their cooperative projects. Beijing threatened Australia and the EU for even suggesting an independent investigation into the origins of the virus.

In May, Chinese CDC officials declared on Chinese state media that they had ruled out the possibility that the seafood market was the origin of the virus, completely abandoning the original official story. As for the “bat woman” herself, Shi didn’t think the lab accident theory was so crazy. In her March interview, she described frantically searching her own lab’s records after learning of the coronavirus outbreak in Wuhan. “Could they have come from our lab?” she recalled asking herself.

Shi said she was relieved when she didn’t find the new coronavirus in her files. “That really took a load off my mind,” she said. “I had not slept a wink in days.” Of course, if she had found the virus, she likely would not have been able to admit it, given that the Chinese government was going around the world insisting the lab had not been involved in the outbreak.

***

A key argument of those Chinese and American scientists disputing the lab accident theory is that Chinese researchers had performed their work out in the open and had disclosed the coronavirus research they were performing. This argument was used to attack anyone who didn’t believe the Chinese scientists’ firm denials their labs could possibly have been responsible for the outbreak.

But one senior administration official told me that many officials in various parts of the U.S. government, especially the NSC and the State Department, came to believe that these researchers had not been as forthcoming as had been claimed.

What they were worried about was something called “gain-of-function” research, in which the virulence or transmissibility of dangerous pathogens is deliberately increased. The purpose is to help scientists predict how viruses might evolve in ways that hurt humans before it happens in nature. But by bypassing pathogens’ natural evolutionary cycles, these experiments create risks of a human-made outbreak if a lab accident were to occur. For this reason, the Obama administration issued a moratorium on gain-of-function experiments in October 2014.

The Wuhan Institute of Virology had openly participated in gain-of-function research in partnership with U.S. universities and institutions. But the official told me the U.S. government had evidence that Chinese labs were performing gain-of-function research on a much larger scale than was publicly disclosed, meaning they were taking more risks in more labs than anyone outside China was aware of. This insight, in turn, fed into the lab-accident hypothesis in a new and troubling way.

A little-noticed study was released in early July 2020 by a group of Chinese researchers in Beijing, including several affiliated with the Academy of Military Medical Science. These scientists said they had created a new model for studying SARS-CoV-2 by creating mice with human-like lung characteristics by using the CRISPR gene-editing technology to give the mice lung cells with the human ACE2 receptor — the cell receptor that allowed coronaviruses to so easily infect human lungs.

After consultations with experts, some U.S. officials came to believe this Beijing lab was likely conducting coronavirus experiments on mice fitted with ACE2 receptors well before the coronavirus outbreak—research they hadn’t disclosed and continued not to admit to. In its January 15 statement, the State Department alleged that although the Wuhan Institute of Virology disclosed some of its participation in gain-of-function research, it has not disclosed its work on RaTG13 and “has engaged in classified research, including laboratory animal experiments, on behalf of the Chinese military since at least 2017.” That, by itself, did not help to explain how SARS-CoV-2 originated.But it was clear that officials believed there was a lot of risky coronavirus research going on in Chinese labs that the rest of the world was simply not aware of.

“This was just a peek under a curtain of an entire galaxy of activity, including labs and military labs in Beijing and Wuhan playing around with coronaviruses in ACE2 mice in unsafe labs,” the senior administration official said. “It suggests we are getting a peek at a body of activity that isn’t understood in the West or even has precedent here.”

This pattern of deception and obfuscation, combined with the new revelations about how Chinese labs were handling dangerous coronaviruses in ways their Western counterparts didn’t know about, led some U.S. officials to become increasingly convinced that Chinese authorities were manipulating scientific information to fit their narrative. But there was so little transparency, it was impossible for the U.S. government to prove, one way or the other. “If there was a smoking gun, the CCP [Communist Party of China] buried it along with anyone who would dare speak up about it,” one U.S. official told me. “We’ll probably never be able to prove it one way or the other, which was Beijing’s goal all along.”

Back in 2017, the U.S. diplomats who had visited the lab in Wuhan had foreseen these very events, but nobody had listened and nothing had been done. “We were trying to warn that that lab was a serious danger,” one of the cable writers who had visited the lab told me. “I have to admit, I thought it would be maybe a SARS-like outbreak again. If I knew it would turn out to be the greatest pandemic in human history, I would have made a bigger stink about it.”

The header is a quote from Joe Costello and seems so on point these days.

“Critical Race Theory” and the Woke-Industrial Complex? Obvious.

A “Sock Puppet” as president easily lost in a DC hardware store, while aides shoo the sundowning old guy back to the home before he has an “accident”? Obvious.

The border collapsing under a southern border invasion now accelerating? Obvious.

PLA Navy escalating warship production? Obvious?

A central bank monetizing accelerating debt and the accelerating USD debasement? Obvious.

Dr. Seuss, Peter Pan, Looney Tunes characters, and a host of childhood icons now racist? Obvious.

So it should be, if I may borrow a word – obvious – that so much is coming.

We had Chris Hamilton yesterday on the obvious population dynamics playing out.

Here’s Chris Whalen on the obvious economic dynamics we’re witnessing: https://www.theinstitutionalriskanalyst.com/post/twisting-towards-us-default

March 4, 2021 | Over the past several weeks, the US treasury market has shown increasing discomfort with the direction of the Biden Administration and the Congress on fiscal matters. Somehow absurd fiscal policy in Washington was not a problem for global capital markets during four years of President Donald Trump, but that benevolent situation appears to have reversed in the first three months of President Joe Biden’s tenure.

Side note: see the similarity?

Anyway, back to Chris.

The Treasury’s fiscal posture is verging on the ridiculous thanks to both parties in Congress. Even as the economy rebounds and banks show little credit impact from COVID — so far — the Democrats in Congress want their trillions in spend to match the profligacy of President Trump. The judgement of the markets on Biden and Treasury Secretary Janet Yellen, however, was illustrated in the nearly failed auction of 7-year Treasury notes at the end of February.

“A big move came in the early afternoon when an auction for $62 billion of 7-year notes by the U.S. Treasury showed poor demand, with a bid-to-cover ratio of 2.04, the lowest on record according to a note from DRW Trading market strategist Lou Brien who called the result “terrible,” reports Reuters.

Even before the auction, Reuters reports, yields on five-year and seven-year notes, the “belly” or middle of the curve, had risen significantly, following weak demand for a 5-year auction.

As investors shunned the recent Treasury auctions, primary dealers were left holding more than half of the paper. And it was at this juncture that the idea of Operation Twist magically reappeared on the scene, but so far only as rumor. We hear that Operation Twist 3.0 was discussed by the FOMC, but our colleague Ralph Delguidice says nothing has been decided as yet.

With the yield spread between 2-year Treasury notes and the 10 year as wide as seen in seven years, the markets have unceremoniously puked all over the idea of further deficit spending to address the quickly receding COVID crisis. Thus, the FOMC it seems must now ride to the rescue of the Treasury.

Most news reporters and economists will tell you that the FOMC’s purchases of Treasury debt and mortgage-backed securities (MBS), which is labeled “quantitative easing,” are some sort of economic policy action. In fact, the Fed’s purchases of Treasury debt represent a subsidy to the US government at the expense of private investors. And as the Treasury’s fiscal situation grows ever more precarious, the FOMC is forced to essentially maintain a market in Treasury debt when the primary dealers are overwhelmed. Like right now.

In one sense, we should all treat the selloff in bonds over the past couple of weeks as a gift, a rare buying opportunity borne of volatility the occurs amidst the general drought of duration engineered by the Federal Reserve Board. Think of the Federal Reserve Bank of New York as a giant financial sump pump, sucking the available duration from the Treasury debt and agency MBS market in vampiric fashion. The Fed then remits the income from these assets to the Treasury, depriving private investors of a return. A remarkable form of stimulus indeed.

But more important than the transfer of interest income to Treasury is the emerging fact of the FOMC standing ready to unconditionally support new US debt issuance in the bond markets. This is a disturbing development for all investors in dollar denominated assets. Like a great black hole in space-time, the FOMC is sucking the resources out of the private economy in order to feed public sector deficits in Washington. President Biden and Italian Premier Mario Draghi have more in common than they know.

Now we can all join (gloved) hands, sing kumbaya and pretend that QE is about forcing down interest rates to help reach full employment and income equality. But increasingly it appears that the FOMC is hurting the US economy by facilitating public debt issuance, something that is ultimately a political problem. In so doing, the Fed is coming dangerously close to violating one of the key tenants of the Federal Reserve Act, namely having the central bank buy debt directly from the US government.

The fact that the FOMC purchases the Treasury debt via the primary dealers is technically correct, but no more. When the primary dealers are already awash in Uncle Sam’s IOUs, then the Fed becomes the proverbial buyer of last resort. The Treasury and the Fed are alter egos, after all, whose separation is a political fiction. One treats a dollar as an asset and the other as a liability, but both are captive to the collective obligations of the United States.

Effective if not actual default by the United States, when the Fed is forced to buy an entire Treasury auction, seems to be merely a matter of timing and the vagaries of the global markets. Even with QE and the possibility of Operation Twist 3.0, the markets may simply walk away one of these days. But until then, we’ll all just keep on dancing. As our friend Joe Costello likes to remind us, Americans are not very good at dealing with the obvious.

In his Econimica blog (https://econimica.blogspot.com/2021/03/the-narrative-of-inflation-amid.html), Chris Hamilton continues to be among the most spot-on analysts in the econophysics. Curiously, he probably doesn’t see himself as an econophysicist.

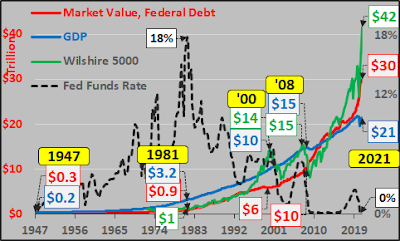

Before jumping to Chris’s recent post, note the year-over-year changes above in key metrics: working age population (increasingly negative), employees (very negative), housing permits (increasingly positive), and 30-yr mortgages (positive and falling).

In a nutshell, at the moment, more houses entering the market even as market participants are declining.

As Chris notes:

Very basically, the major driver of economic growth is the growth of that population of consumers, their income, savings, and access to credit. If that population is growing at 1.5% annually then you can add an additional 1.5%+ growth for maintaining &/or building out greater production, supply chain, housing, infrastructure, etc to support that larger consumer base. This essentially gets us to a 3% growth in GDP.

Let’s jump into the back-end of Chri’s blog but you should read the whole thing: https://econimica.blogspot.com/2021/03/the-narrative-of-inflation-amid.html

So, when I show the year over year change (qtrly basis) of the total population versus GDP since 1960, it should be clear why we need the economy to grow ever less in order to serve us…because there is ever less growth to be served by the economy (below)! 2020 growth was 1/7th that seen in 1960 (yes, on a % basis).

And when I include the year over year change in the working age population (15-64yr/olds…red line below), well, we now have outright declining annual demand from the segment of the population that drives the economy…so flat’ish GDP should about be adequate to take care of flattish demand? But the Fed would call that recession and provide more interest rate cuts, more QE, more acronyms yet to be invented to goose activity to suit the needs of the financial system.

So, the Federal Reserve is targeting 2%+ GDP growth (really, significantly higher) against minimal population growth (minimal rising demand) because the economy is no longer about serving our needs…it is now we and the distorted/manipulated economy that is serving the needs of the federalized financial Ponzi scheme. As the chart below highlights, as the Federal Reserve has pushed rates ever lower, this ever cheaper/greater debt has not served the people or GDP…instead it has rewarded the minority asset holders for being asset holders…simultaneously punished the majority non-asset holders for not holding assets.

It’s usually at this point people start to ask what’s it all about…what is the end game? Since the Fed is privately owned by the largest banks in the world (and they are owned by the 1% of the 1%)…why do these people need more money? I think the simple answer is they don’t need more money. This isn’t about turning their hundreds of millions into billions or billions into tens of billions. I detail the US domestic demographic, economic, financial picture HERE…but no, there seems a different point to all this than making the fabulously wealthy wealthier…suggested HERE.

Summary – The US (and world, at large) is looking at an unexpected and increasingly large decline in births, young, and working age adults. The declining child bearing populations coupled with increasingly negative fertility rates are resulting in an inverted pyramid of continued growth among elderly propagating the collapsing population of young. The result is we appear to be at a tipping point that will result in a realignment of nearly the entire demographic, social, political, economic, and financial systems we’ve come to know and expect. This realignment is likely to be like a magnetic field realignment built around de-growth, managed decline.

Extra Credit for those curious on market valuations…never have investors paid more for less potential growth among consumers (and never, ever have investors paid anything for a declining base of consumers…so FUBAR…but that is where the Fed has led us, so what else you gonna do?). Below, Wilshire 5000 (green line, representing all publicly traded US equities), market value of federal debt (red line, as per Dallas Fed), and year over year change in working age population (yellow line).

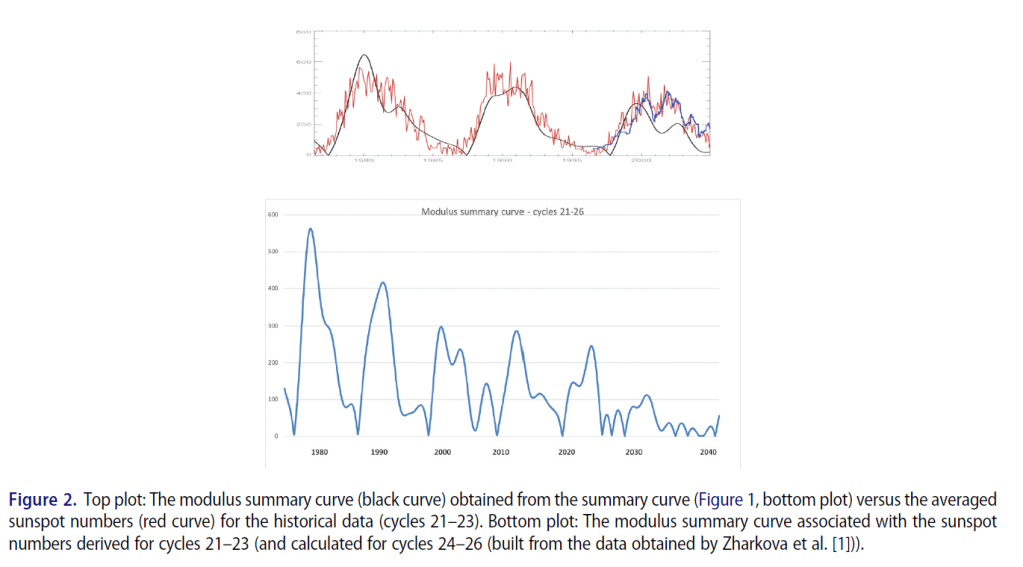

The solar cycle is at a minimum with the onset of Solar Cycle 25.

As is also apparent, the more active solar period that peaked in the first decade of the 22nd century is now entering a 30 year low activity period.

Higher seismic activity correlates with low solar activity.

We are already seeing evidence of that higher seismic correlation.

Three major earthquakes struck just north of New Zealand, including one of the strongest ever to hit the region, triggering tsunami warnings:

Aseismic cluster of this intensity is rare.

But, recall at the start of Solar Cycle 24, Japan experienced a 9.1M event on March 11, 2011.

Ten years ago, New Zealand marked the 10th anniversary of the 6.3M that destroyed parts of Christchurch in the south Island, killing 185 people.

Earthquake-swarms are continuing to intensify under many of the world’s volcanoes, including those of Iceland as well as some of the 18 that run along the Cascade Volcanic Arc in western North America; here, Mount Rainier and Mount Hood are among the ones to watch.

The Cascade Arc has history of “lighting up” during the onset of Grand Solar Minimums, and this time isn’t expected to be any different.

Marchitelli et al. (2020) discuss the relationship between solar cycles and activity, and seismicity:

Large earthquakes occurring worldwide have long been recognized to be non Poisson distributed, so involving some large scale correlation mechanism, which could be internal or external to the Earth. We have recently demonstrated this observation can be explained by the correlation of global seismicity with solar activity. We inferred such a clear correlation, highly statistically significant, analyzing the ISI-GEM catalog 1996–2016, as compared to the Solar and Heliospheric Observatory satellite data, reporting proton density and proton velocity in the same period. However, some questions could arise that the internal correlation of global seismicity could be mainly due to local earthquake clustering, which is a well-recognized process depending on physical mechanisms of local stress transfer. We then apply, to the ISI-GEM catalog, a simple and appropriate de-clustering procedure, meant to recognize and eliminate local clustering. As a result, we again obtain a non poissonian, internally correlated catalog, which shows the same, high level correlation with the proton density linked to solar activity. We can hence confirm that global seismicity contains a long-range correlation, not linked to local clustering processes, which is clearly linked to solar activity. Once we explain in some details the proposed mechanism for such correlation, we also give insight on how such mechanism could be used, in a near future, to help in earthquake forecasting.

Herdiwijaya et al (2015) reached similar conclusions.

Principal component analysis by Zharkova (2020) report the current minimum will extend out some 2-3 decades.

Consistent with Zharkova, Courtillot et al. (2021) observe from their study of sunspot frequency since 1749 that the aphelia of the four Jovian planets could be the principal drivers in solar activity.

They conclude from their planetary model with a prediction that Solar Cycle 25 that can be compared to a dozen predictions by other authors: the maximum would occur in 2026.2 (± 1 yr) and reach an amplitude of 97.6 (± 7.8), similar to that of Solar Cycle 24, therefore sketching a new “Modern minimum”, following the Dalton and Gleissberg minima.

Hajra (2021) arrives at a similar conclusion. Noting Solar Cycle 24 (December 2008 – December 2019) is recorded as the weakest in magnitude in the space age (after 1957), Hajra analyzes Solar Cycles 20 through 23, and finds Solar Cycle 24 is both the weakest in solar activity, but also in average solar wind parameters and solar wind–magnetosphere energy coupling.

This resulted in lower geomagnetic activity, lower numbers of high-intensity long-duration continuous auroral electrojet (AE) activity (HILDCAA) events and geomagnetic storms. The Solar Cycle 24 exhibited a ≈ 54 – 61% reduction in HILDCAA occurrence rate (per year), ≈ 15 – 34% reduction in moderate storms (−50 nT ≥ Dst > −100 nT), ≈ 49 – 75% reduction in intense storms (−100 nT ≥ Dst > −250 nT) compared to previous cycles, and no superstorms (Dst ≤ −250 nT).

So, as GHG concentration continues to rise and climate temperatures trend south due to weakening solar activity, will the expected rise in seismicity be attributed to GHG emissions?

Or, will veritas vincit?

References:

Courtillot, V., Lopes, F., & Le Mouël, J. L. (2021). On the prediction of Solar Cycles. Solar Physics, 296(1). doi:10.1007/s11207-020-01760-7

Hajra, R. (2021). Weakest solar cycle of the space age: A study on solar wind–magnetosphere energy coupling and geomagnetic activity. Solar Physics, 296(2). doi:10.1007/s11207-021-01774-9

Herdiwijaya, D., Arif, J., Nurzaman, M. Z., & Astuti, I. K. D. (2015). On the possible relations between solar activities and global seismicity in the solar cycle 20 to 23. AIP Publishing LLC.

Marchitelli, V., Troise, C., Harabaglia, P., Valenzano, B., & De Natale, G. (2020). On the long range clustering of global seismicity and its correlation with solar activity: A new perspective for earthquake forecasting. Frontiers in Earth Science, 8. doi:10.3389/feart.2020.595209

Valentina Zharkova (2020) Modern Grand Solar Minimum will lead to terrestrial cooling, Temperature, 7:3, 217-222, DOI: 10.1080/23328940.2020.1796243

There are more than a few industries that are “financially challenged” these days.

Malls:

Cruise ships:

But if you’re really into depression, try the airlines.

Here’s Time Knight at Slope of Hope: https://slopeofhope.com/2021/03/peak-airlines.html#more-194288

I’d say they were in for some rough air ahead.

And, broadly speaking:

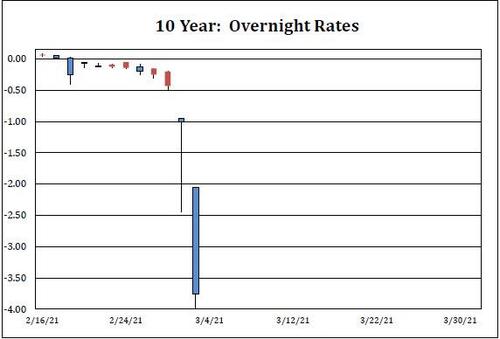

ZeroHedge on the short pileup: https://www.zerohedge.com/markets/historic-repo-market-insanity-10y-treasury-trades-4-ahead-monster-short-squeeze

Actually scratch that: last week there were barely any shorts in the 10Y – that’s why the massive stop loss liquidation after last Thursday’s 7Y auction was just longs puking. It was only after that the flood of shorts arrived and hammered the 10Y to “fails” levels in repo.

What does that mean in English?

As we have discussed in the past, TSYs trade special, or anywhere between 0% and -3% in repo (and while they may trade at, they never drop below the fails charge), whenever there is a massive pile up of shorts. Think of it as a borrow on a stock at some insane percentage: 100%, 1000%, etc. It’s similar in rates, only such mechanics take places in the repo market and a rate of -3% is usually considered the equivalent of extremely hard to borrow. Even so, never before have we encountered a 10Y trading so special it was below the fails charge.

Why would anyone buy below the Fail Charge? As Skyrm explains, in the Treasury market, if you fail to deliver to a counterparty, there’s a fail charge equal to 300 basis points below the lower bound of the fed funds target range. The equivalent of a -3.00% Repo rate. There are a variety of reasons why a Repo desk will cover a short below the Fail Charge rate – which include: keeping clients happy, avoiding internal meetings/explanations, and internal rules that require shorts to be covered. None of this explains why the repo rate would drop to the mathematically improbable -4%, except to suggest that something is starting to crack in the repo market itself.

Skyrm concludes by saying what what we noted above, namely that “what’s important is that trading below the Fail Charge implies a real deep short-base.”

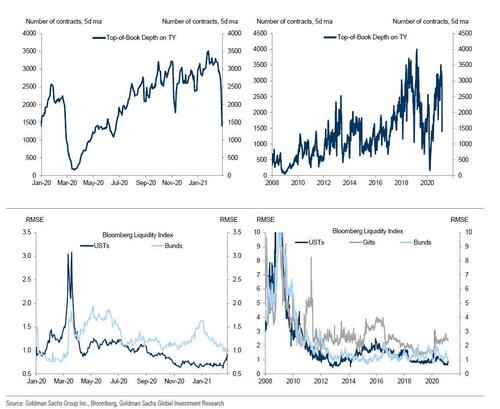

So what does this mean in the bit scheme of things? Recall what we showed yesterday using the latest data from Goldman – there is zero, nada, zilch liquidity in Treasurys. Indeed the last time the top-of-book depth was this low was during the peak of the Covid crisis last March.

At the same time, the latest repo data merely confirms that all the price action is entirely on the short side and explains much of today’s action. In fact, never before has there been such a massive pile up of shorts in the 10Y.

This is important because it means that the imbalance in the bond market is no longer just a fundamental bet by traders expecting inflation: there is also something profoundly wrong with the actual market structure itself so much so that if left unchecked it could lead to catastrophic consequences for the world’s (once upon a time) most liquidity market.

Meanwhile, none other than the Fed vice chair Lael Brainard, who was until very recently expected to become the next Treasury secretary and is widely considered to be Powell’s replacement as Fed Chair, said on Tuesday that the Fed is now “paying attention”:

I am paying close attention to market developments — some of those moves last week and the speed of those moves caught my eye. I would be concerned if I saw disorderly conditions or persistent tightening in financial conditions that could slow progress toward our goal.

Maybe on Tuesday the Fed did not see “disorderly conditions” but in light of the historic move in repo on Wednesday, the Fed no longer has the luxury of waiting.

What this also means is that tomorrow, when Powell speaks at the Wall Street Journal virtual event which begins at noon, the Fed Chair will likely strongly hint that the Fed will either extend the SLR exemption by another 3-6 months (we explained the critical significance of the SLR term extension earlier in “Why The SLR Is All That Matters For Markets Right Now“), or that the IOER or RRP rates will be hiked to unclog the sudden build up of collateral and push it back in the market. Perhaps the Fed will go so far as suggesting a new Operation Twist will be activated in the coming months (ahead of the Fed’s taper announcement). Incidentally, our base case is that Powell will make it clear the current SLR term, will be extended as the Fed will want to hold on to YCC until just before it announces tapering in H2.

Whatever Powell does, he will have to do something to unfreeze not just the bond but now also the repo market, as the alternative is a market this is now literally broken, something former NY Fed repo guru Zoltan Pozsar predicted last week (see “Here We Go Again: Zoltan Warns Repo Market On Verge Of Major Shock As Key Funding Rate Turns Negative“).

And speaking of Pozsar, this is what he said in his latest Global Money Dispatch note which we touched on earlier:

For every macro narrative that explains why U.S. treasury yields are rising, there is also a plumbing narrative that can explain things with equal persuasion.

So yes, Powell and the Fed could ignore the rise in yields as long as the turmoil did not spread to the repo market – such a move could be explained by the reflationary macro narrative – but now that the 10Y is trading below the fails charge in repo the repo market is officially cracking and as Sept 2019 taught us, there is nothing that the Fed is more worried about than the sanctity of the repo market.

Finally, what happens if we are right and Powell does assure the market that SLR will be extended? Well, since all of the pent up uncertainty about whether or not bank balance sheets will be usable after March 31 will disappear, what will happen is a monster short squeeze as all those shorts that pushed the 10Y to -4% in repo panic and scramble to cover, sparking a massive surge higher in prices (and plunge in yields), and since there will be immediate follow through to stocks where concerns about rising yields just sent risk assets plunging, we expect a monster move higher in stocks tomorrow.

In fact, judging by the freefall in futures, we wouldn’t be surprise if the Fed announces that the SLR exemption will be granted at the usual pre-market time of 830am.

In any case, stay tuned because there will be fireworks – most likely to the upside – but if for some reason Powell refuses to unclog the repo market, there will be blood.