The Durham Report: https://www.justice.gov/storage/durhamreport.pdf

Key Takeaways:

- “The FBI discounted or willfully ignored material information that did not support the narrative of a collusive relationship between Trump and Russia.”

- Crossfire Hurricane “was opened as a full investigation without [the FBI] ever having spoken to the persons who provided that information.” Days after it was opened, Peter Strzok was telling a London FBI employee that “there’s nothing to this.”

- Internal FBI communications discussing the Crossfire Hurricane during its early stages: it’s “thin” and “it sucks”.

- British Intelligence pushed back on Mueller requests for assistance: “[a British Intelligence person] basically said there was no [expletive] way in hell they were going to do it.”

- Durham documents TWO investigations into Hillary Clinton – one involving the Clinton Foundation and one involving illegal foreign contributions to Clinton’s Campaign.

- In one Clinton Campaign investigation, an FBI confidential human source (CHS) had offered an illegal foreign contribution to the campaign through an intermediary. The Clinton Campaign was “okay with it” and “were fully aware”. The CHS offered the FBI a copy of the credit card charge; the FBI never got receipts. In fact, the FBI handling agent told the CHS “to stay away from all events relating to Clinton’s campaign.”

Here is Mark Wauck’s take: https://meaninginhistory.substack.com/p/bull-durham-master-of-the-bleeding

Bull Durham, Master Of The Bleeding Obvious: The Russia Hoax Really Was A Hoax

The Real Story: The US/UK Deep State And Their Political Enablers Got Away With This Hoax, And Got The Disastrous War On Russia That They Wanted. The Losers In All This? Look In The Mirror.

MAY 15, 2023

So that’s the big news after all these years—the Russia Hoax really was a hoax. As if anyone with an IQ above room temperature ever doubted it. Here’s Zerohedge’s summary of this not-so-stunning revelation:

According to Just the News, the report concludes that the FBI had no verified intelligence or evidence when it opened up an investigation into Donald Trump and his campaign in the summer of 2016.

Durham placed blame on the FBI and DOJ for failing to follow their own standards in a probe which should have never taken place – including the agency’s surveillance of an American citizen without basis.

Let’s repeat that: The investigation should never have taken place simply because there was no reasonable basis for it. None. “No verified intelligence or evidence.” And this stuff was reviewed by the best legal minds the FBI and DoJ could come up with. Do you really think they were fooled into believing there was a reasonable basis? If you do, read the next two paragraphs.

“Based on the review of Crossfire Hurricane and related intelligence activities, we concluded the Department and the FBI failed to uphold their important mission of strict fidelity to the law in connection with certain events and activities described in this report,” wrote Durham.

“The FBI personnel also repeatedly disregarded important requirements when they continued to seek renewals of that FISA surveillance while acknowledging — both then and in hindsight — that they did not genuinely believe there was probable cause to believe that the target [Carter Page] was knowingly engaged in clandestine intelligence activities on behalf of foreign power.”

Let’s be totally clear about this. Durham’s bottom line conclusion was obvious from the very start—all the way back in the summer and fall of 2016. It almost makes me ill to think of the amount of time I spent beating this dead horse. It was always about “predication”—the requirement that investigative agencies of the federal government have some reasonable and articulable basis for believing that a criminal offense occurred before opening an investigation. That’s basic, and it’s the core issue before you even get to the probable cause requirements in FISA. I’m not going to go into this again. Anyone who wants to go over this again can just delve into past posts that I’ve pulled up by doing basic searches, like: predication, probable cause, FISA, Carter Page, Christopher Steele, and any other searches you care to come up with. How could it take years for Bull Durham to come to such an obvious conclusion? Yeah, I know …

Trust me on this—everyone involved knew it was complete bullshit from the very start, just like Durham says. Here’s a tell on that from Techno Fog. While the Deep State, led by the FBI and DoJ, was targeting Trump based on their hoax, what were they doing about known serious violations by Hillary?

The FBI and DOJ restricted two investigations into Hillary Clinton during the 2016 election:

1) The Clinton Foundation investigation

2) Illegal foreign contributions to the Clinton Campaign

“No investigative activities occurred for months”

— Techno Fog (@Techno_Fog) May 15, 2023

According to an FBI CHS in early 2016, the Clinton Campaign was “fully aware” of and “ok with” a foreign contribution in violation of federal law.

The FBI agent didn’t get receipts – and asked the source to stay away from the Clinton campaign.

The FBI made “no effort” to investigate “the Clinton campaign’s acceptance of an illegal “campaign contribution that was made by the FBI’s own long-term CHS.”

The obvious conclusion is that the Deep State was determined to push the Russia Hoax on Trump and get it into the public consciousness, at the same time that they were determined to Deep Six any real information that could harm Hillary by revealing what she really is. How soon into their review do you think Durham and Barr realized this? Let’s be charitable and say, by the end of the first week. After all, Barr wrote that famous memo to Rosenstein saying as much.

Jonathan Turley is reviewing the 300 page non-bombshell report and will, no doubt, produce an article. In the meantime he has provided tweets as he proceeds throught he report. Here are what he see as five key points that the media should—but won’t—dig into:

(1) There was never a foundation for the launching of the Russian collusion investigation that occupied most of the Trump presidency.

(2) Salacious reports like the Moscow hotel tape appear to be entirely invented by the Steele team funded by the Clinton campaign.

(3) the Steele dossier was not only funded and pushed by the Clinton campaign, but General Counsel Marc Elias pushed the media campaign (and later refused to cooperate voluntarily with investigators).

(4) DOJ and FBI officials violated core departmental standards, including some [who had] … a “predisposition” to investigate Trump.

(5) [T]he lack of support and contradictions of these allegations were clear from the outset.

Again: From the start. They knew it was bullshit all along. Just as we all did. How did it take so long for Durham to write that report?

Turley gets into all the hypocrisy of the media and the mendacious, dishonest conduct of the FBI and DoJ—and please never, ever, forget the key enabling role of the DoJ. However, he cites two passages in the report that I want to take issue with:

Another notable line: “on July 26, 2016, Clinton allegedly approved a proposal from one of her foreign policy advisors [Jake Sullivan] to tie Trump to Russia as a means of distracting the public from her use of a private email server.”

Durham notes “Foreign Policy Advisor-1 [Jake Sullivan] stated, however, that it was possible that [Clinton] had proposed ideas on these topics to the campaign’s leadership, who may have approved those ideas.”

Please don’t buy into that narrative. The reality is that the emails and the server weren’t a significant campaign issue. The Deep State saw to that by the totally irregular means of having a RINO FBI Director decline prosecution on an utterly bogus rationale. The FBI has no authority to do that, but the Deep State brazened their way through, with political cover from the DC establishment. But Hillary went ahead with the Russia Hoax. Why?

Think of the risks Hillary ran—right? If anyone in the media or, God forbid, the FBI or DoJ had taken a close look at the whole Russia Hoax narrative, she could have been exposed as playing fast and loose with a national security hoax without regard for the implications for relations with a major nuclear power. That would be very bad—right?

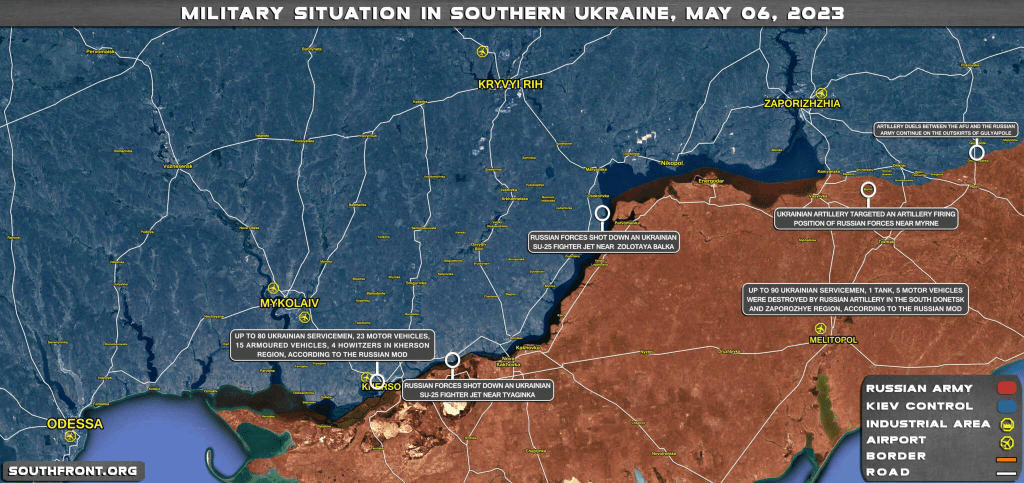

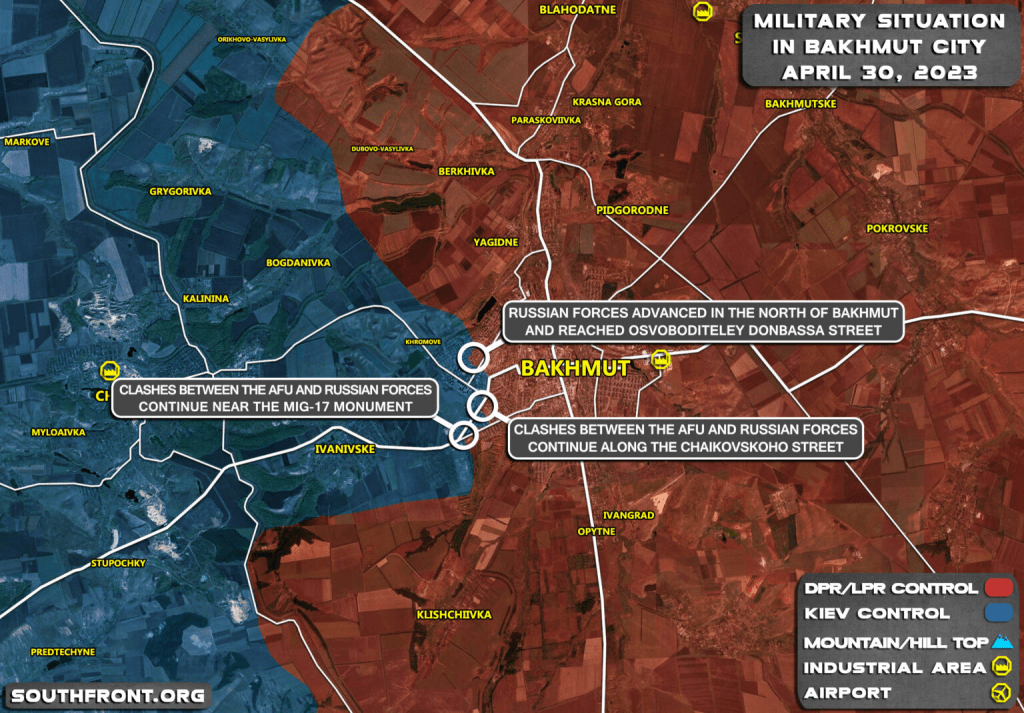

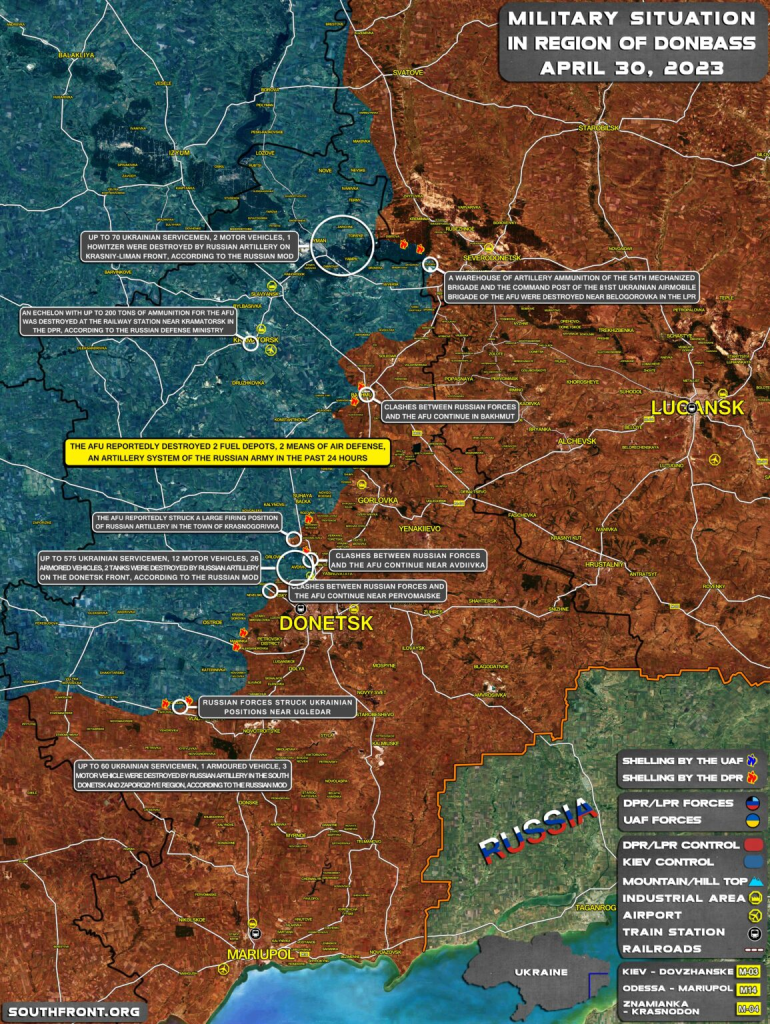

Except that we know she ran no such risk at all. The media, the Deep State, the DC political establishment—they were all in the tank for HIllary. Why? Because of Trump’s crazy idea of doing a deal with Russia, coming to an understanding with Russia so that America could deal with China from a position of considerable strength. The Deep State wanted nothing to do with that—they had been planning the dismemberment and subjugation of Russia, the despoiling of Russia’s natural resources, ever since the end of the Cold War. Hillary was totally part of that Neocon cabal. In fact, during the closing years of the Obama regime the Neocons had actually put in place the perfect mechanism for bringing this plan to fruition, by overthrowing the Kiev regime and beginning the process of arming Ukraine to the teeth. And Trump could throw a spanner into that.

From this perspective we can see that the Russia Hoax play two roles. On the one hand, it would help put HIllary—an indifferent campaigner and shrewish personal presence at best—over the top. But the claim of Russian interference in a presidential election could gin up righteous outrage among the American public and lend support for the coming war with Russia. In the event, of course, Hillary lost. The Russia Hoax ended up being used by the Neocons mostly to tie Trump’s hands on foreign policy with regard to Russia. A Hillary regime might have seen a sanctions war to the hilt, such as we now see, before Putin had prepared Russia for that eventuality. Trump’s presidency, despite his own sanctions regime, put that plan on hold—thus the undying Neocon hatred for Trump.

However, the DC Establishment rallied around Joe Biden to defeat Trump. Key in this effort, Bluto Barr buried the Hunter laptop, turned a blind eye to the prospect of massive election fraud and to Antifa violence—beyond protecting a few public buildings—and enabled Durham’s slow walking of the Russia Hoax investigation, with nothing really to show for it except confirmation of the bleeding obvious. And so here we are. The Ruling Class got Biden installed in the White House, they got their war, and now America is facing geopolitical defeat on a grand scale thanks to our corrupt Ruling Class. You have to wonder. But for the Russia Hoax, would the war on Russia even have been possible? The constant repetition of the false claims that Russia had “meddled” in our election, the bipartisan consensus in that lie—to what degree did that enable the war on Russia by preparing the American public to accept such madness because Russia evil? Coupled with the long running coup against Trump—faux impeachment based on Ukraine, protecting Zhou’s Ukraine dealings, and all the rest.

Two closing thoughts.

First, I get Turley’s outrage at the media. Pulitzer’s all round for the hoaxers at the NYT, but none for the NYPost’s coverage of the Hunter laptop. But for a guy who spends so much time discussing constitutional issues, isn’t it high time for him to turn his attention to the reality of a Ruling Class that leads America into wars without a by your leave from We The People?

Second, wouldn’t it have been a gracious gesture on Durham’s part to acknowledge and thanks Trump for his role in forcing all this political and Deep State corruption out into the light of day, for We The People to see it for what it is. The last decade or so has been a Great Awakening for so many of us, and nobody deserves more credit in that regard than Trump.

********************************************************************************************

You can say you were witness to history:

A coup executed by the Democrat National Committee, the Obama Regime, and the Executive Branch.

One that ended with two impeachments and corruption of the 2020 election.

And has now brought us into a Proxy War with Russia.