Holding the line – it’s a phrase that flows through history. Poetic imagery.

Like the Battle of Iswandllwana:

At Thermopylae, King Leonidas I of Sparta faced overwhelming odds from the Achaemenid Empire of Xerxes I over the course of three days during the second Persian invasion of Greece. As Herodotus tells us: “Here they defended themselves to the last, those who still had swords using them, and the others resisting with their hands and teeth.”

The list is endless – Masada, Mecca, Kosovo, Agincourt, Constantinople, Stand of the Swiss Guard, Fort St. Elmo, Alamo, Kabul, Little Big Horn, Rorke’s Drift, Warsaw Ghetto, Berlin.

Some were triumphant in the face of the onslaught (Agincourt) – most, well, not so. Aftr all the odds are overwhelming in last stands.

But all glorious(?) At least the poets say so.

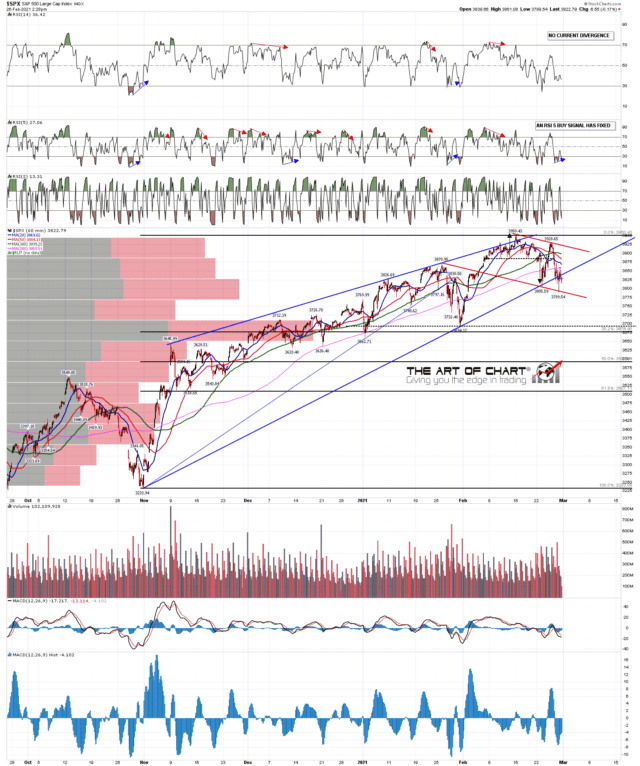

And so, in the tradition of Last Stands, we find Evil Speculator draw the SPX battle line (https://evilspeculator.com/battle-lines/). ES offers us two scenarios:

Scenario A:

- A drop through 380 followed by a snap back higher (which is what we’re seeing in the ES futures right now).

- From there the previous lows holds and we are done with this correction.

Scenario B:

- A drop through 380 followed by a reversal or retest higher.

- The retest fails or fizzles out and gravity takes over drawing us toward 370 or even lower.

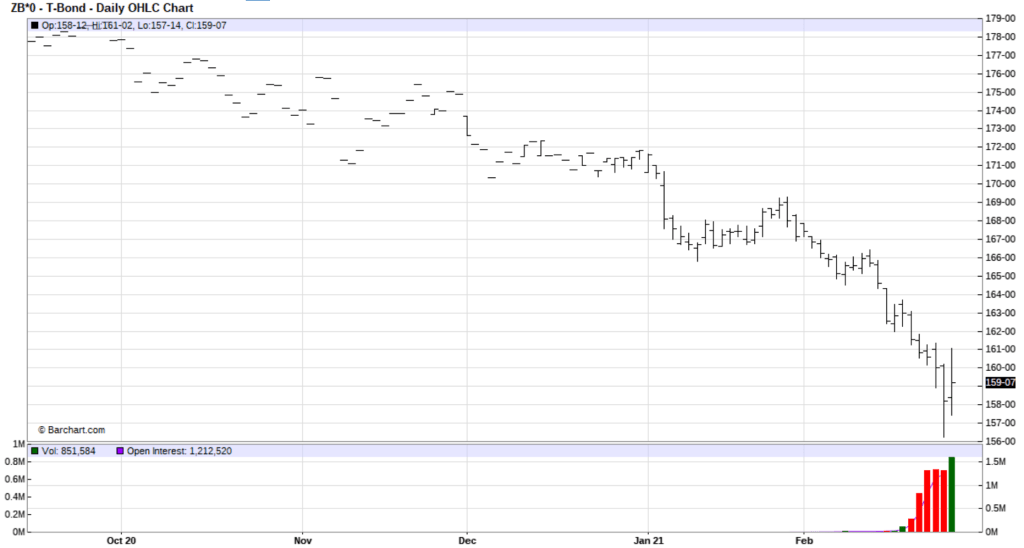

The canary in the bond “landmine” could well be ZB – treasuries.

How long it will last is anyone’s guess but the battle line has been drawn and it’s at the 156 mark. Let me be crystal clear about this: If that threshold is being breached in the near future then it will open the floodgates of panic selling.

For those of you scoring at home, here’s the latest ZB – a true last stand picture. This is where acceleration to the downside may be far too much to successfully pull out:

Will bonds hold the line? They’re coming up on it fast and acclerating.

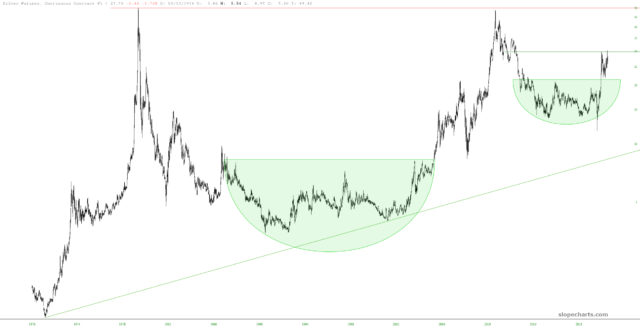

Over at Slope of Hope, Tim Knight sees bull flags forming among the rising wedges and retracements: https://slopeofhope.com/2021/02/likely-bull-flags-forming.html

Thermopylae? Or Agincourt?

Hard to say.

This story shall the good man teach his son;

And Crispin Crispian shall ne’er go by,

From this day to the ending of the world,

But we in it shall be rememberèd—

We few, we happy few, we band of brothers;

For he to-day that sheds his blood with me

Shall be my brother; be he ne’er so vile,

This day shall gentle his condition;

And gentlemen in England now a-bed

Shall think themselves accurs’d they were not here,

And hold their manhoods cheap whiles any speaks

That fought with us upon Saint Crispin’s day.

William Shakespeare Henry V, Act IV Scene iii(3)