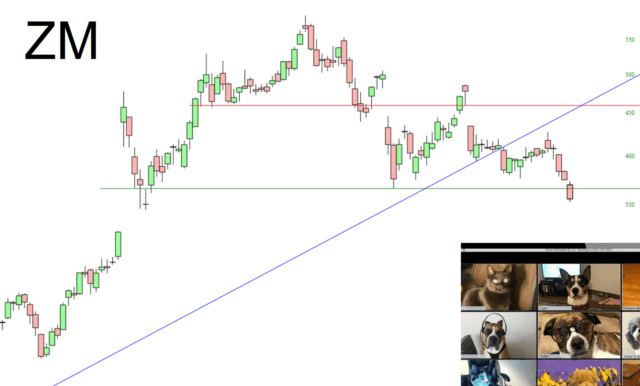

ZOOM (ZM) is suffering a serious break-down – off 40% from its peak.

And while we’re celebrating new additions to the short list, consider the other “poster child” – Peloton

Let’s be careful out there.

“This is the way.”

ZOOM (ZM) is suffering a serious break-down – off 40% from its peak.

And while we’re celebrating new additions to the short list, consider the other “poster child” – Peloton

Let’s be careful out there.

“This is the way.”

“Most Americans think there was wholesale fraud in the election. Almost all of Trump’s voters think the election was stolen. How can The Pretender rule when close to half the people think he’s illegitimate? If he gets the Epstein treatment and Willy Brown’s concubine is installed, how can the political class keep pretending America is a democracy? That seems unlikely.

“Given all the problems the ruling class of the American Empire created in 2020, it is natural to assume 2021 must be better. The thing is, the bumbling fools who created this mess are still in charge, The odds of them working through these problems without creating more trouble are very low. It is entirely possible that a year from now, people will look fondly back on 2020 as an age of relative calm.”

Indeed. Z-Man nails it.

J. Wolinsky:

“Based on the dot.com experience, popping bubbles are often associated with the complete collapse of companies like eToys, Pets.com or Webvan, but that is as much the exception as the rule. It is equally common that following an immense and unsustainable rise in stock price, the bubble pops without much change in the operations and profitability of the company. Instead, the bubble is based on the development of a wildly enthusiastic prediction of the company’s future and is popped by the recognition that the forecasts were wildly enthusiastic. All of this can happen without much change in ongoing operations. The best way to illustrate what can happen is with some examples.”

Kyriazis et. al (2020) review the asset bubble literature for cryptocurrency and apply the Augmented Dickey Fuller (ADF) and Log-Periodic Power Law (LPPL) methodologies to the pricing data. They conclude from the academic research Bitcoin appears to have been in a bubble-phase since June 2015, while Ethereum, NEM, Stellar, Ripple, Litecoin and Dash present evidence of bubble-like characteristics since September 2015.

Returning to Wolinsky, individual bubble dynamics do not appear associated with “mass extinction” events.

References:

Kyriazis, N., Papadamou, S., & Corbet, S. (2020). A systematic review of the bubble dynamics of cryptocurrency prices. Research in International Business and Finance, 54(101254), 101254.

jwolinsky. (n.d.). Popping Bubbles. Retrieved December 28, 2020, from Slopeofhope.com website: https://slopeofhope.com/2020/12/popping-bubbles.ht

To be clear, I have not reviewed his analysis – YET. But I did download his analysis of Arizona fraud by going to his firm’s website and providing contact details: https://www.preactiveinvestments.com/

Per Gateway Pundit:

“Piton revealed this weekend that he examined just over 9 million records in Pennsylvania and has identified 521,879 unique last names.

“In other words, these people have no parents, siblings, aunts, uncles or cousins who share the same last name (phantom voters).”

Between 695,000 to 958,000 voters voted and then vanished out of Pennsylvania according to his analysis.

The good news – he has a CFA. The bad news – he has an MBA and not an MS or PhD in a quant science. But, some MBAs – usually the ones with a CFA – are competent in statistical analysis.

So, we shall see.

Quite a year:

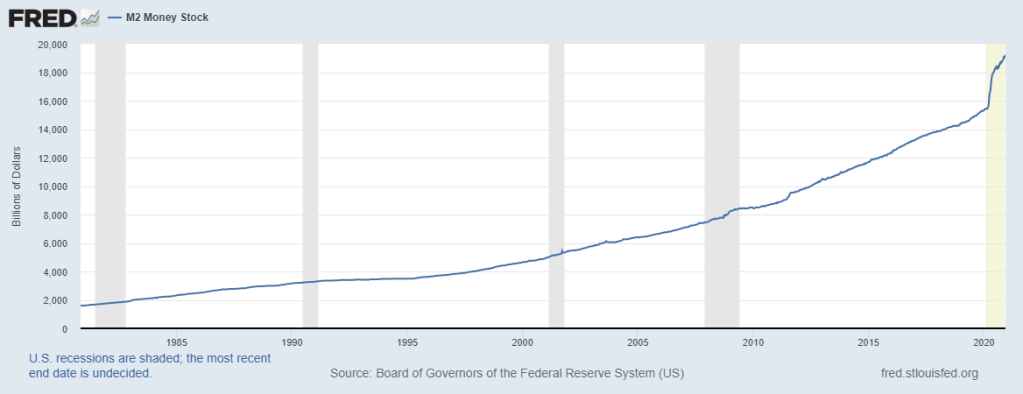

Before the latest “stimulus” on the Congressional table, inflation was evident in food and shelter prices as the M2 rose exponentially. Injecting $900 billion more constituted an extraordinary shock.

Michael Snyder:

“In the short-term, ‘stimulus payments’ from the federal government will definitely help tens of millions of suffering Americans.

“But of course every additional dollar that our government borrows and spends just makes our long-term problems even worse.

“A national economic meltdown has begun, and our politicians will try lots of things to mitigate the damage, but all of their “solutions” will only help temporarily.

“This is going to be an exceedingly dark chapter for America, but most Americans still do not understand the true nature of the crisis that is now unfolding all around us.”

For 55 Percent Of Americans, 2020 Has Been “A Personal Financial Disaster”

Confronted by a growing presence by the PLA Navy, the Indian Navy launched a new airbase in the strategically located Andaman and Nicobar islands in 2019. The new base will monitor PLA Navy activity in the region.

The Andaman Sea can become the next flashpoint of Sino-Indian maritime rivalry in the Indian Ocean Region (IOR) given Beijing’s interest in the region and continued operations in Indian waters without permission.

Just last month, the Indian Navy test-fired a new supersonic anti-ship missile, the BrahMos class, which is reportedly the world`s fastest operational system in its class.

Office spaces could be down 10 to 15% even after the economy recovers, adding that rents in top markets such as New York and San Francisco will continue to experience declines in 2021.

CRE crisis unfolding.

Let me guess what follows – “bailouts ahead.”

https://www.zerohedge.com/markets/companies-dump-office-space-inventory-swells

Death toll from the COVID-19 virus relative to other historic pandemics all the way back to Roman times.

Black Death is still the winner – hands down.

Courtesy of Visual Capitalist: https://www.visualcapitalist.com/history-of-pandemics-deadliest/

My old professor, Murray Rothbard, explained the dynamics decades ago:

“The first people to get the new money are the counterfeiters, which they use to buy various goods and services. The second receivers of the new money are the retailers who sell those goods to the counterfeiters. And on and on the new money ripples out through the system, going from one pocket or till to another. As it does so, there is an immediate redistribution effect. For first the counterfeiters, then the retailers, etc. have new money and monetary income they use to bid up goods and services, increasing their demand and raising the prices of the goods that they purchase. But as prices of goods begin to rise in response to the higher quantity of money, those who haven’t yet received the new money find the prices of the goods they buy have gone up, while their own selling prices or incomes have not risen. In short, the early receivers of the new money in this market chain of events gain at the expense of those who receive the money toward the end of the chain, and still worse losers are the people (e.g., those on fixed incomes such as annuities, interest, or pensions) who never receive the new money at all.”

Now decades later, Charles Hugh Smith summarizes the damage done:

“Of the many things we cannot bring ourselves to admit, one of the most consequential is that our vaunted middle class is illusory, a phantom of our imagination rather than a reality. The reality is the vast majority of the nation’s wealth and income has been diverted from the middle class to those at the pinnacle of the wealth-power pyramid and the technocrat / financier insider class (the top 10%) that serves the interests of those at the pinnacle.

“This transfer has accelerated rapidly in the 21st century as virtually all the real income gains of the past 20 years have flowed to the top 0.1%. This RAND study found that America’s elites siphoned $50 trillion into their own pockets in the past two generations: Trends in Income From 1975 to 2018. (Please look at the “Fruits of Financialization” chart below.)

“The earnings of the top 0.1% grew 15 times faster than the earnings of the bottom 90% (See chart below) as wages’ share of the economy continues its 50-year decline.”

This process accelerated when Nixon closed the gold window in 1973 in order to play the Keynesian card of deficit spending.

Deficit spending gave us trade deficits process accelerated under Clinton. Since China entered the WTO, the US bleedout went ballistic.

And now that we have “la famiglia criminale Biden” running the executive branch – literally, business partners of the Red Ponzi and owned by financial elites – while socialists run Congress, we know this ends only one way – more financialization, more deficits, and more rewards to the plutocracy.

Here is Charles Hughes Smith: http://charleshughsmith.blogspot.com/2020/12/our-phantom-middle-class.html