I think that’s called a planetary conjunction.

Wedges Broke to the Downside

Can’t say I didn’t say “heads up”. I mean, that was a Triple-7 climbing out and they do tend to drop things.

Well, Tim Knight was kind enough to observe the Plunge Protection Team in the Monetary Politburo stepped in with still more debt/inflation for American households to prop up the Money Class.

But let’s let Tyler summarize the smack-down: https://www.zerohedge.com/markets/momo-dumps-powell-pumps-crypto-slumps

A bad day for people with the word “wood” in their name (too soon?).

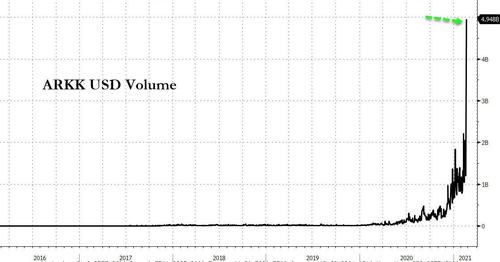

Tiger tumbled his car and Cathie’s ARKK Invest crashed even harder…

ARKK USD-volume today was un-fucking-believable! That’s a fifth of the ETF’s market cap!

Source: Bloomberg

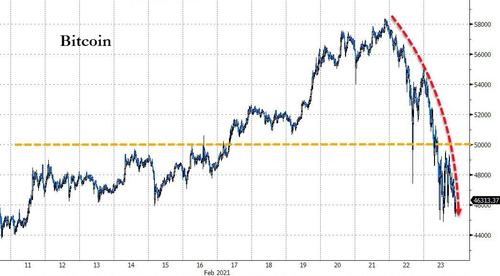

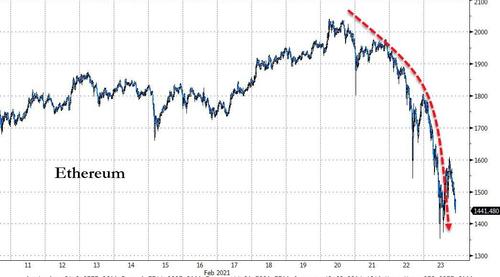

Cryptos were crushed.

Bitcoin back below $50k…

Source: Bloomberg

Ether ended back below $1500…

Source: Bloomberg

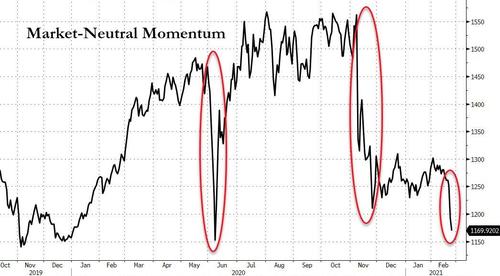

Momentum crashed…

Source: Bloomberg

And while stocks were clubbed like a baby seal at the cash market open...

…Powell’s promise of moar of whatever it takes (which is exactly what he has now said consistently for a year) sparked the standard buying panic, lifting the Dow (orange), S&P (green), and Nasdaq (blue) back to unchanged, Small Caps (red) ended red…

[COMMENT: mo’ dough for Greenwich, mo’ inflation for the rest of us]

NOTE: Europe’s open also saw major selling pressure

“Did you not hear a single word of what I just said? Buy the f**king dip!”

Nasdaq found support at its 50DMA…

[COMMENT: 50DMA saves the day]

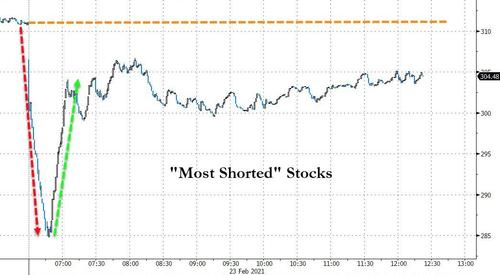

“Most Shorted” Stocks puked by the most since March 2020 at the open, only to be squeezed back higher…

Source: Bloomberg

Energy stocks ended the day best with Cons Disc worst but everything levitated after the initial puke…

Source: Bloomberg

[COMMENT: can you say Super-Cycle?]

TSLA tumbled but dip-buyers also screamed in there too…

Could be worse – could be Workhorse…

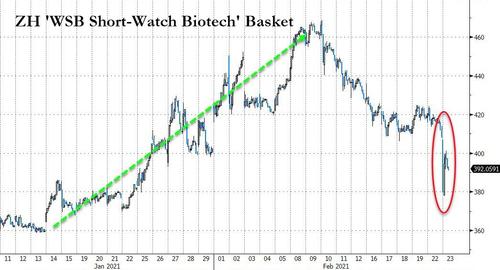

Small Cap Biotechs had a bad day…

Source: Bloomberg

Bonds were mixed with the belly outperforming the tails (30Y +3bps, 5Y -2bps, 2Y unch)…

Source: Bloomberg

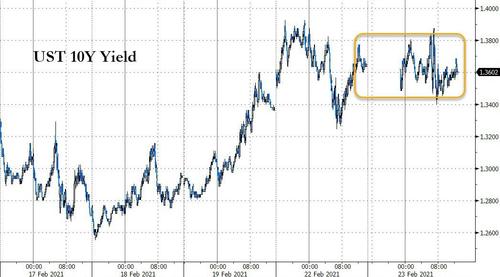

Despite all the chaos in stocks, 10Y Yields traded in a very narrow range on the day…

Source: Bloomberg

The dollar ended lower are tumbling along with stocks at the equity open…

Source: Bloomberg

Gold was lower on the day, but held above $1800… just…

Oil prices continued higher with WTI back above $62 ahead of tonight’s API inventory data….

[COMMENT: again, can you say Super-Cycle?]

Finally, the most-crowded longs held by hedge funds has erased all its losses relative to the massive WSB short-squeeze (of the “most-shorted” stocks)…

Source: Bloomberg

And if Biden and his pals want $1.9 trillion stimulus, they better get it done soon before this pandemic is over…

Source: Bloomberg

References

https://www.zerohedge.com/markets/momo-dumps-powell-pumps-crypto-slumps

CCP/SARS-CoVid-19 Fully Sequenced

In a bioRxiv preprint, Chen et al. (2021) report the results of the first genomic sequencing of the virus.

Chen traces CCP back to RaTG13 and RmYN02 – strains reported by Chinese researchers as detected in Yunnan province of China, but yet to be found elsewhere.

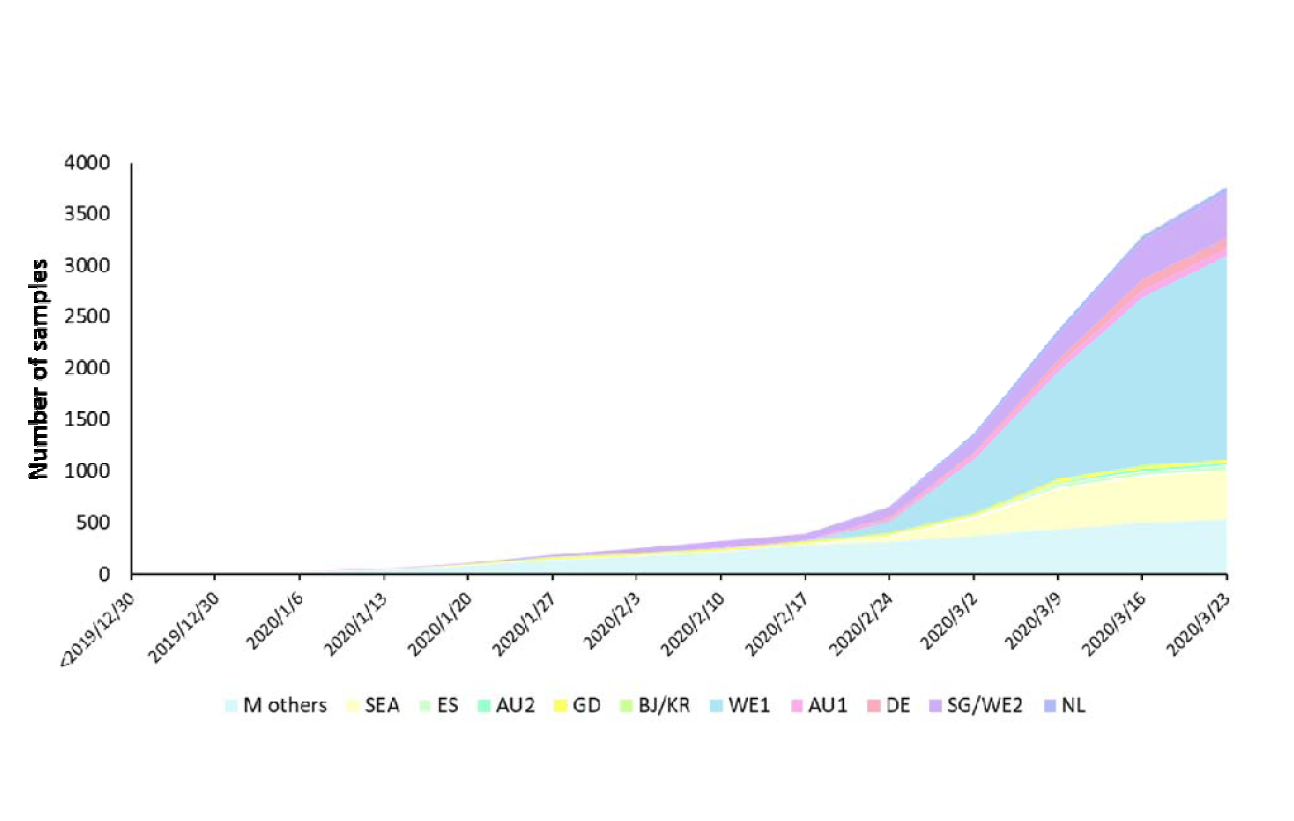

The study considered over 4,000 full-length viral sequences made available by the Global Initiative for Sharing All Influenza Data (GISAID) EpiFlu database. Another 11 came from a Chinese database. Lastly, Chen analyzed ~2,61,000 genomes collected globally since the pandemic began. This comprises all the genomes in the database.

The researchers were able to identify distinct genotypes based on how commonplace certain mutations were. This helped trace superspreaders since they shaped the pandemic to a large extent. These individuals passed on specific genotypes with certain highly prevalent mutations. A single introduction of such genotypes led to an outbreak of infection, increasing evolution with spread.

Six genotypes appear to have descended from the original strain with a single sequence – the M type variant originating in Wuhan – and responsible for more than 80% of the sequences in the study. Chen considers this as a true founder, and evident in spread to other regions of China before the Wuhan lockdown.

The six descendant genotypes are directly derived from the ancestral strain by characteristic mutations. The most prevalent genotype among these was the WE1 type, defined by four mutations. Three of the four defining mutations of the WE1 strain were found in three early samples collected in January 2020. Among WE1 genomes, 70% came from Western Europe (the UK, Iceland, Belgium, France, and the Netherlands, perhaps by traffic across the borders. It also made up ~35% of cases in the US.

The SEA type is the most common in the USA, however, but was isolated from three other countries, namely, Australia, Canada, and Iceland, indicating that cases from the USA had been imported there. This is also called the Washington State outbreak clade. The other four descendant genotypes were confined regionally.

The 34 sequences from early Wuhan cases showed two clusters, 30 belonging to the M type, but with extensive diversity. The remaining four formed another co-circulating cluster. Thus, at this early stage, there were 18 different genotypes among the 34 sequences.

In the USA, the prevalent strains belonged to the non-M types, probably from 12 cases imported from the Hubei province. These, in fact, were the earliest cases reported in the USA, with each showing a distinct genotype.

Half the US cases were SEA type, while ~35% were WE1. It indicates that the USA “endured the first wave of case importation from China and the second wave from Europe, which is consistent with the recent COVID-19 study of Washington State.” Among the 32 patients on the two cruise ships, the Grand Princess and the Diamond Princess, there were 25 different genotypes. This indicates that the virus mutates rapidly and extensively during person-to-person transmission.

The researchers developed a Strain of Origin (SOO) algorithm to match each genotype to its genome by mutational profile. When compared with mutation clustering, this approach showed a 90% agreement.

Using the same approach, they found that three of the top four GISAID clades were descendants of WE1. They estimated that one of three nucleotides in the viral RNA had undergone mutation over the 12 months of the pandemic.

They analyzed the top 100 mutations and generated a lineage-based pedigree chart. This story begins with a putative first case, supposed to be a patient with an ancestral SARS-CoV-2 genotype, and postulated to be present on November 17, 2019. This led to more infections. By January 1, 2020, the Huanan market was locked down, and 19 M type genome samples were documented.

However, the M type had already been incubating in the market for weeks, which accounts for the vast majority of genomes belonging to the M type at this time. With the expansion of the outbreak into Wuhan city at large, the city was locked down on January 23, 2020, with 80% of the viral genomes being of the M type. However, the Spring Festival had already prompted extensive travel to and from Wuhan, leading to the Chinese and then the global outbreak of COVID-19.

By April 7, 2020, more than 80% of cases worldwide were M type, but in September, 70% belonged to WE1, in three clades, namely, GR, G, and GH. The rise in M type continued, making up ~98% of cases by December 25, with almost 90% being caused by WE1 strains.

The researchers conclude that beginning with a single superspreader incident, the M type exploded over the world, following a few initial weeks when it passed unrecognized and uncontrolled. The M type acquired two concurrent mutations first, with another four defining mutations that led to the emergence of WE1 strains, and finally, another three that led to the WE1.1 strain. The rate of viral evolution, at ~27 substitutions per year, is not unusual, but the mechanism is still unclear.

Of the two new mutant strains attracting much attention, namely, the D614G point mutation and the N501Y mutation in the receptor-binding domain, both in the spike protein, are thought to be highly transmissible compared to the ancestral strain. The former was first documented in Western Europe in February 2020 and now makes up ~90% of strains, while the latter was first found in New York City on April 21, 2020, and makes up only 0.02% of cases.

Reference:

Chen, Y., Li, S., Wu, W., Geng, S., & Mao, M. (2021). Distinct mutations and lineages of SARS-CoV-2 virus in the early phase of COVID-19 pandemic and subsequent global expansion. doi:10.1101/2021.01.05.425339

Large-scale genome sequencing shows how SARS-CoV-2 mutated. (2021, January 10). Retrieved February 22, 2021, from News-medical.net website: https://www.news-medical.net/news/20210110/Large-scale-genome-sequencing-shows-how-SARS-CoV-2-mutated.aspx

ZB – Free Fallin’

But what’s more important is that it is dropping while picking up velocity while realized volatility is also dropping.

Connect the dots McFly.

Or, let Evil Speculator do it for you: https://evilspeculator.com/the-pressure-cooker/

Mmm num ba de

Dum bum ba be

Doo buh dum ba beh beh

Pressure pushing down on me

Pressing down on you, no man ask for

Under pressure that burns a building down

Splits a family in two

Puts people on streets

Остаться в живых

Вы можете сказать по тому, как я использую свою прогулку

Я ходячий человек, некогда говорить

Музыка громкая, а женщины теплые, меня пнули

С того момента, как я родился

И теперь все в порядке, все в порядке

И вы можете посмотреть в другую сторону

Мы можем попытаться понять

Влияние New York Times на человека

Будь ты брат или мать

Вы остаетесь в живых, вы остаетесь в живых

Почувствуйте, как рушится город, и все дрожат

И мы остаемся живыми, мы остаемся живыми

Ах, ха, ха, ха, остаться в живых, остаться в живых

Ах, ха, ха, ха, останься в живых

Ну, теперь я тону и кайфую

И если я тоже не могу, я действительно стараюсь

Небесные крылья на моей обуви

Я танцую и просто не могу проиграть

Вы знаете, все в порядке, все в порядке

Я доживу до следующего дня

Мы можем попытаться понять

Влияние New York Times на человека

Mind the Wedgies

Wedges are characterized by a contracting range in prices coupled with a trend – upward is a “rising wedge” while downward is a falling wedge.

Wedges are transitive – they form near the top or bottom of a trend and often resolve within ~4 weeks.

In the case of an upward trend, resolution can trigger a breakout towards every price points.

Or a correction in the case where the new top is not sustainable.

Which means it might be a good idea watching things.

If you’re interested in the range of wedges converging out there, check out Tim Knight of Slope of Hope: https://slopeofhope.com/2021/02/watch-those-wedges.html

You Drop a Bomb on Me

The Hard Realities of Population Dynamics and Accelerating Debt

Chris Hamilton’s Econimica blog remains one of my favorites. In his latest posting, Chris’s punchline remains on-point and entertaining

Some say these are the seeds of the second American revolution as a class of unelected, undemocratic central bankers enrich a tiny majority at the expense of the majority…but I just like making colorful charts.

I might add if you are in the business of marketing credit, Chris has a depressing story to tell.

Anyway, here’s Chris: https://econimica.blogspot.com/2021/02/just-charts-of-demographicswith.html

Some folks want to make economics seem complicated. It ain’t. Any who, some charts depicting the US economy…through demographics.

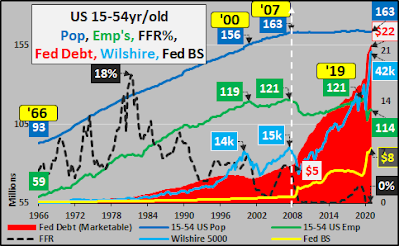

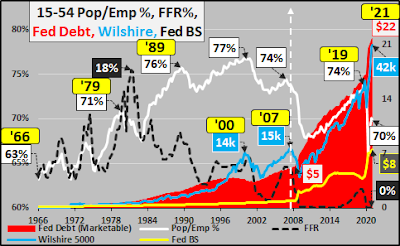

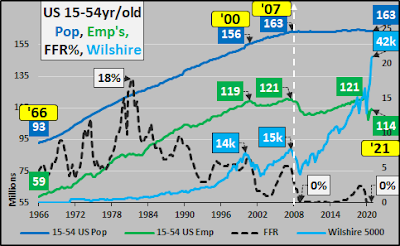

First, 15 to 54 year old US population (blue line) and those employed among that population (green line). You may note the end of population growth among them in ’07 and not only the end but a significant decline in employment among them since ’07. This is the population segment that undertakes most of the credit (creating the new $’s via undertaking debt…vs. elderly who destroy $’s via deleveraging/paying off their loans), buys most the homes, spends the most, earns the most. The lack of growth among them is paramount in understanding what took place in ’08 as potential new home buyers ceased to exist and banks gave credit to anyone to keep the party going…’08 (and what has come since) was an entirely predictable demographic caused crisis.

Same as above but plus Federal Reserve set Federal Funds Rate % (black dashed line) and it’s relationship to marketable federal debt (red shaded area). When working age population growth ceased, the Federal Reserve implemented ZIRP (free money to the largest banks) and likewise free money to Congress. The explosion in debt since is entirely due to the Federal Reserve’s encouragement via their interest rate policy.

Same as above but inclusive of Federal Reserve balance sheet (aka, QE…yellow line) and Wilshire 5000 (representing all publicly traded US equities…light blue line). Since the end of working age population and employment growth, virtually free money has been passed to the largest and best connected US institutions / individuals. This, alongside the Federal Reserve purchasing Treasury bonds (to artificially lower the cost of federal government borrowing and boost the supply of dollars chasing the remaining assets) and mortgage backed securities (to artificially lower mortgage rates) has resulted in an asset explosion. This explosion has rewarded asset holders with vast riches and punished young adults, the poor, those on fixed incomes. These folks in the latter group get none of the asset wealth effect but instead get the fast rising costs of living due to the asset appreciation. When the Federal Reserve continually suggests they aren’t responsible for the exploding US inequality…it is a bald faced lie.

Same as above, but focusing on the 15 to 54 year old employment to population ratio (not the silly unemployment numbers the BLS puts out…just dividing the population by those employed among them…white line). The Federal Reserve has two Congressionally mandated jobs…”promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates.” You can forget stable prices (as the Fed has, via a system of discounting inflation) and just focus on full employment. As you’ll note, the US has achieved “full employment” four times since the inclusion of females into the workforce…’89, ’00, ’07, ’19…each time with employment around 75% of the available population. But note the declining rates, resulting in greater debt, resulting in soaring asset bubbles (and once those failed) notice the soaring QE and zero interest rate policy…resulting in the greatest rise in asset appreciation in US history. Asset holders made rich (for being asset holders)…those with little or no assets made poor (for not being asset holders). Simple stuff.

Below, again 15 to 54 year old horizontally moving population plus falling employed among them, ever lower Federal Funds Rate, and ludicrously vertical Wilshire 5000. In case you are wondering, this asset explosion is not a naturally occurring phenomenon against over a decade of zero working age population growth and seven million fewer employed among them. Nah, this looks like a currency collapse in progress…and once it goes vertical (Wilshire, Bitcoin, etc.)…you know you haven’t got much longer to go (although we likely have significantly further to go in the vertical explosion…before the whatever it is that follows).

While nobody can say whether immigration will return to high levels, fertility rates and births are scraping record lows…and simply gauging the feeder population that is the 15 to 24 year olds (chart below of population / employed among them), you should have a fairly good idea of why a return to a growing working age US population isn’t likely.

Finally, here’s how this plays out regarding the most fundamental of human needs…shelter or housing…plus I’ll stretch out to the 15-64yr/old population and employed among them versus annual housing starts and the Federal Funds Rate (%). The Federal Reserve purchasing of MBS / QE has artificially pushed mortgage rates to record lows to induce an artificial housing frenzy amid a secular turn to outright declining potential buyers and soaring quantity of potential sellers (elderly who already own homes). If I didn’t know better, I’d think the Fed hates young adults and is setting them up to be the bag holder of an awful oversupply of very expensive housing when the bottom invariably falls out…again.

Some say these are the seeds of the second American revolution as a class of unelected, undemocratic central bankers enrich a tiny majority at the expense of the majority…but I just like making colorful charts.

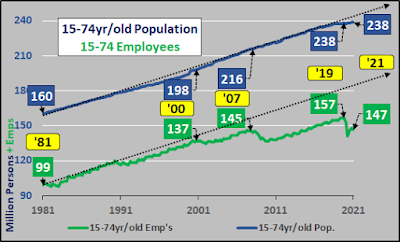

Extra Credit – 15 to 74 year old population / employees For those curious how this looks on the widest possible cross section of population/potential employees, the following are the same charts but showing the 15 to 74 year old population and employees among them.

Last chart is pretty important, because it really highlights the declining participation of the aging population…suggesting that “full employment” will be significantly lower than ’06 and ’19 at much greater expense and require significantly greater QE to enable it all.

Invest (wtf) accordingly.

The Limits of Climate Change due to GHG Sensitivity

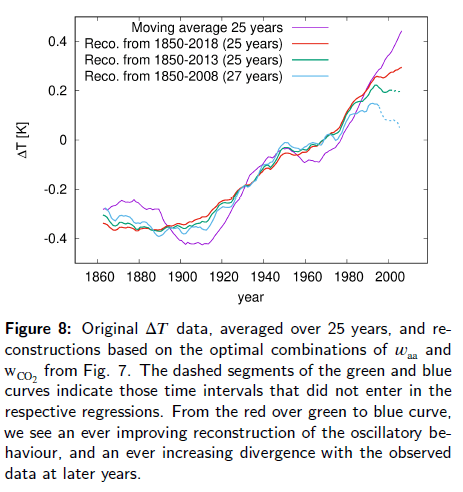

Stefani (2021):

The two main drivers of climate change on sub-Milankovic time scales are re-assessed by means of a multiple regression analysis. Evaluating linear combinations of the logarithm of carbon dioxide concentration and the geomagnetic aa-index as a proxy for solar activity, we reproduce the sea surface temperature (HadSST) since the middle of the 19th century with an adjusted 𝑅2 value of around 87 per cent for a climate sensitivity (of TCR type) in the range of 0.6 K until 1.6 K per doubling of CO2. The solution of the regression is quite sensitive: when including data from the last decade, the simultaneous occurrence of a strong El Niño on one side and low aa-values on the other side lead to a preponderance of solutions with relatively high climate sensitivities around 1.6 K. If those later data are excluded, the regression leads to a significantly higher weight of the aa-index and a correspondingly lower climate sensitivity going down to 0.6 K. The plausibility of such low values is discussed in view of recent experimental and satellite borne measurements. We argue that a further decade of data collection will be needed to allow for a reliable distinction between low and high sensitivity values. Based on recent ideas about a quasi deterministic planetary synchronization of the solar dynamo, we make a first attempt to predict the aa-index and the resulting temperature anomaly for various typical CO2 scenarios. Even for the highest climate sensitivities, and an unabated linear CO2 increase, we predict only a mild additional temperature rise of around 1 K until the end of the century, while for the lower values an imminent temperature drop in the near future, followed by a rather flat temperature curve, is prognosticated.

This Arxiv preprint employs a multiple regression analysis with the time series of the geomagnetic aa-index as a proxy for solar activity (“aa-index”) as an independent variable along with the logarithm of CO2 concentration commonly used in climate models. Stefani shows that the temperature variation since the middle of the 19th century can be repro-

duced with an (adjusted) 𝑅2 value around 87 per cent.

Stefani achieves such a high goodness-of-fit (exceeding IPCC AR5 correlation for a GHG-only model) by employing specific combinations of the weights of the aa-index and of CO2 forming a nearly linear function in their two-dimensional parameter space.

Stefani’s reports climate sensitivity in the range between 0.6 K-1.6 K (per 2× CO2). He interprets this finding as a transient climate response (TCR), rather than an ECS.

Notably, Stefani’s results correspond well with that of Lewis and Curry (2018), 0.8 K-

1.3 K.

Reference:

Lewis, N., Curry, J. (2018). The Impact of Recent Forcing and Ocean Heat Uptake Data on Estimates of Climate Sensitivity. J. Climate 31, 6051-6071.

Stefani, F. (2021). Multiple regression analysis of anthropogenic and heliogenic climate drivers, and some cautious forecasts. Retrieved from http://arxiv.org/abs/2101.05183

Doug Casey on Robinhood

Doug Casey: https://internationalman.com/articles/doug-casey-on-robinhood-hedge-funds-and-class-warfare/

International Man: We seem to be entering a new paradigm in the financial markets. Social media has allowed a large number of small investors to band together and move markets in ways that were previously inconceivable.

What are your thoughts on this and what lies ahead?

Doug Casey: To start with, most of the people on Robinhood are ultra-unsophisticated—mostly unemployed kids living in their mothers’ basements. A lot of the money that the government sent them—the COVID checks—went into the market.

Of course, Robinhood itself is somewhat problematic with its commission-free trading and no minimum trade size. How can a company make money if it doesn’t charge its customers anything? It does so by having cozy arrangements with hedge funds. In essence, you get what you pay for, and if you don’t pay anything, you can expect to be treated like you’re a product, not a customer. I don’t have any problem per se with Robinhood’s business model, but Robinhood’s real customers are probably the hedge funds, not the public.

I don’t have any sympathy for anybody involved in this—hedge funds, the brokers, or the public. In the markets, eventually, everybody gets what they deserve. Still, the fact that some hedge funds have lost billions is front-page news. And the stock running from like $3 before collapsing from $450 to under $50 at the moment means plenty of late-arriving small fry will have been wiped out on the way down.

Especially now, under the Biden regime, it’s likely to provide an excuse for more regulations. Among the main beneficiaries of that will be the SEC. Which, from a practical point of view, means its upper-level employees. After logging a few years with the SEC, they’re able to walk through the revolving door and retail their experience and their connections to major law firms for high six- or even seven-figure salaries. The bigger the scandal, the more they’re worth.

I’m sure that the SEC is going to “step in” and “do something” as a reaction to the GameStop episode. We have an activist government on our hands.

International Man: The established large institutions and hedge funds are not happy with the new reality.

Many brokerages have put restrictions on certain stocks, like allowing people to only sell, not buy. Others have limited buys to 1 share, which is effectively prohibiting buys. Other brokers have allegedly sold shares without the consent of the owner for “their own good”—even when no leverage was involved.

Perhaps this is all technically within the legalese of the broker’s terms of service. Regardless, it gives the impression that the markets are rigged against the little guys.

What do you make of this?

Doug Casey: Well, it appears that GameStop has a very poor business model. Few people walk into retail stores to buy games anymore; they mostly download the software on the Internet. GameStop is a sinking ship, and it was rational on the part of the hedge funds to short it. It seemed the company was going the way of Blockbuster and its video rentals.

Of course, hedge funds were heavily short in the stock. Based on fundamentals, they were right. The Robinhooders, newbies innocent of fundamental analysis, piled into it simply because it was a cheap stock, much the way they did previously with Hertz, AMC, and some others.

The fundamentals, however, don’t mean anything when there’s a tidal wave of buying. If a hedge fund was short at $4 and the stock doubles to $8, it’s basically lost a hundred percent of its invested capital. And if it goes to over $400, as it did, they’ve lost it many times over. At some point, a hedge fund can be bankrupted even though its initial position, in short, was small. Margin calls from brokers can force them to buy, to cover the short, at any cost, which drives the stock even higher.

From the hedge funds’ point of view, GameStop is the perfect illustration of the old saying, “the market can stay irrational longer than you can stay solvent.” Or, if you wish, the truth of the line in Ecclesiastes, “the race is not to the swift, nor the battle to the strong, neither yet bread to the wise, nor yet riches to men of understanding, nor yet favour to men of skill; but time and chance happeneth to them all.”

It’s rumored that the shorts lost in the neighborhood of $25 billion on the play, with one fund totally busted with a $3 billion loss. Some Robinhooders who got long early and sold near the top made huge killings. But the ones who got long and stayed in over $50—where it currently trades—have lost money. The stock is still likely headed for near zero. The ones who got long over $100 have gotten creamed.

I know they’re whining about how Robinhood broke up the play. And I agree—the broker should be there strictly to place the bets, not try to alter the outcome of the game, even to save people from themselves. Which, incidentally, it did. The poor fools might have jammed GME to $1000, which would have been really ugly for the little guys but a delight for a new group of hedge funds that would have jumped on to ride it down.

Perversely, by doing the ethically wrong thing and saving the hedge funds bacon, Robinhood accidentally kept millions of the “little people” from losing their shirts.

International Man: Many of the people who bought stocks of companies with questionable business prospects at ludicrous valuations—like GameStop—knowingly put their capital at extreme risk. They seemed willing to engage in an act of self-destruction and lose money for the chance to stick it to Wall Street and the Hedge Funds. It smells like class warfare.

What does this say about where society is going?

Doug Casey: You’re right. It’s kind of a form of class warfare bubbling to the surface. Interestingly, some government officials are trying to somehow tie the Robinhood gamblers in with the people involved in the disturbance of January 6th at the Capitol. The Robinhooders might be viewed as financial populists, financial terrorists trying to overthrow “the Man.”

It’s another indication of the basic instability of everything today. It’s not just the US financial markets, propped up by trillions of fiat dollars created by the Federal Reserve. The social and political instability we have as well is more important.

Robinhooders who buy bankrupt companies during a financial bubble will eventually be wiped out. Even the ones that bought cheap and closed out their positions for big profits are probably living in a fool’s paradise right now. They’re like the guy who bets on the winning number in roulette, wins, figures he’s a genius, and keeps playing.

Perhaps with GameStop as high as it is right now, it will do a secondary offering and fill up their treasury, allowing them to stay alive a bit longer. But that’s a huge misallocation of capital. Any capital GameStop raises—by printing more shares—is unlikely to be used productively. It’s just staving off the inevitable, another disastrous consequence of the Fed’s insane ZIRP and QE policies.

International Man: What are the investment implications of all of this?

Doug Casey: People forget that before Nixon devalued the dollar in 1971, on a typical day, trading on the NYSE was at maybe at 10 or 15 million shares. Now trading is in the hundreds of millions of shares per day. That’s not a sign of economic health, and it’s not fostering actual economic activity financing real businesses, which is what the stock market is supposed to be about. It’s a sign of a massively overfinancialized society caused by massive money printing.

Markets have become a gambling casino. And why might that be? Again, it’s because there’s so much money and credit being created. It has to go somewhere. It’s all very destructive—and the ultimate perpetrator is the Federal Reserve.

Regardless of what the SEC may try to do, this will happen again and again—perhaps in the commodity markets, as well. It may happen in silver. Unlike in the stock market, where a company like GameStop can print up more shares to bail itself out, as well as trapped shorts, in the commodity markets, you can’t instantly increase production in order to deliver the commodity in question.

Silver is experiencing upward pressure now. Most silver buyers tend to be true believers. For many years, there have been rumors floating around about naked shorting of gold and silver—of supposed evildoers going out of their way to suppress the price of the metals. This is a completely ridiculous allegation. In fact, the big money doesn’t care about the metals to start with. But it’s a good-sounding meme that will draw in the little guys hoping to punish the big guys.

When it comes to silver, I hope the Robinhooders get in. And take silver to $100 an ounce.

That’s just one of many reasons I’m long silver. And I hope to stay long until I hear of a Gamestop-type mania in silver.